ASCO 2025: Bicara vs. Merus in a Set-to-Change Head & Neck Cancer Treatment Paradigm

While Bicara took a hit after Merus released its ASCO data, there is strong reason to believe that Bicara could end up coming out on top in the end

At ASCO, we saw three very interesting data readouts from three companies hoping to establish themselves as the new standard of care in Head & Neck cancer. I’m of course talking about Petosemtamab (LGR5xEGFR bsAb, Merus), Ficerafusp alfa (TGF-beta x EGFR fusion protein), and PDS0101 (HPV+ T-cell enhancer, PDS Biotech). All three of these players are pursuing development in 1L Head & Neck Squamous Cell Carcinoma (HNSCC) in combination with pembrolizumab, but in very different ways. And after their respective data releases, this market is headed for an interesting fork in the road.

Comparing the Bicara and Merus Data Updates

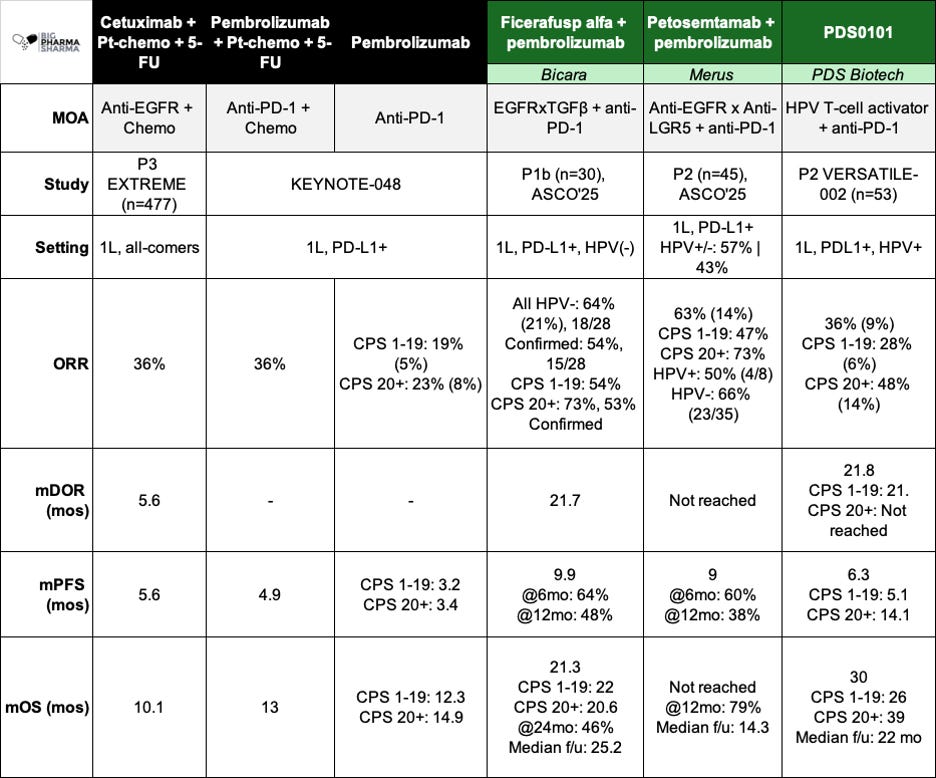

Perhaps it’s best to view the key efficacy data here side-by-side. I pulled this into a comparison table below. More complete data can be found from company publications (Bicara ASCO’25 Clinical Update , Merus ASCO’25 Abs#6024, PDS ASCO’25 Poster 445)

Right off the bat you get a sense of why Bicara’s stock was down following Merus’ initial data release (just before ASCO). While Bicara is focusing its development on HPV-negative (HPV-) disease (more on that in a moment), Merus has studied Petosemtamab (peto) across both subtypes and seen numerically higher responses (54% confirmed ORR vs. 63%) in the blended population. On top of that, most of the patients in the peto population were indeed HPV-, where the drug also numerically exceeded Ficerafusp, 54% to 66%. Getting a drug that has higher ORR across both HPV segments would seem to be better in this instance – why would a physician prescribe the less efficacious drug first, even in the HPV- setting where Bicara is focused?

Looking to extend your company or brand’s reach with the Biopharma community? Consider sponsoring the next edition of Big Pharma Sharma. You can learn more about sponsored posts via this link and how to get your product, company, or service in front of my audience of Biopharma decision-makers.

Looking at higher quality outcomes like PFS and OS, the gap seems to narrow a bit but still tilts a bit in favor of peto. Ficerafusp is a touch higher on PFS (9.9 vs. 9 months) but seems weaker on overall survival (21.3 months vs. not reached). The mOS needs to mature a bit to have a fairer comparison, as Ficerafusp has nearly double the follow up of peto, however if you eyeball the landmark OS at the 12-month mark, it sort of looks like peto is still ahead (~60% for Ficerafusp vs. 79%. Now these are still blended numbers (HPV negative and positive), so we don’t know how much the data from the four HPV+ responders is buttressing this survival data, but they only make up about 19% of the population, so my guesstimation is that peto still comes out ahead, albeit with earlier follow-up.

So, all of the above puts Bicara in a bind, but there’s still quite a bit of light left at the end of this tunnel.

Deeper Responses May Mean Ficerafusp is Note Dead Yet

Bicara has already started repositioning and counter-messaging to strengthen the public perception of Ficerafusp. Their CEO had a nice interview with Brad Loncar on Biotech TV and their updated corporate deck starts to lay the groundwork for much of what I would recommend they do to reset expectations about Ficerafusp, while also backing their competitor, Merus into an interesting corner.

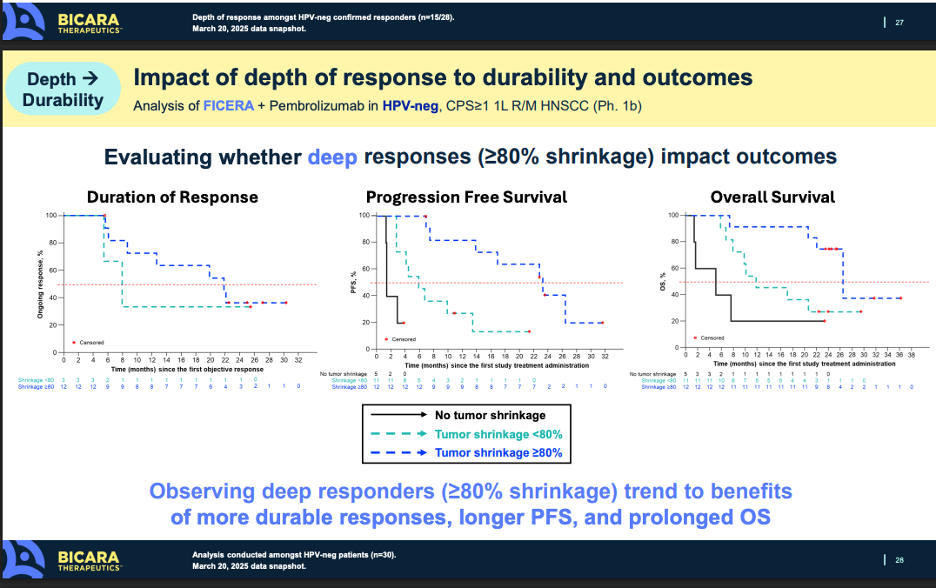

The key points the corporate messaging brings up, and what I agree with, is that depth of response is key to efficacy. Intuitively there is no surprise here. Generally, with solid tumors, if you are able to generate deep responses (like complete responses), those patients normally do better than patients with less profound responses.

Ficerafusp did demonstrate a 21% CR rate, numerically better than the 14% Petosemtamab showed. If this dynamic holds in the companies’ respective P3 studies, there is a good chance that the increased depth of response could translate to prolonged OS on a cross-trial basis. It’s important to remember that approval (and more importantly coverage) in the 1L setting will be dictated by showing benefit on overall survival. Both molecules appear as thought they could clear the bar of pembro monotherapy (or pembro + chemo) in a pivotal study, but there is an argument to be made that because of the depth of response and early OS data, Ficerafusp could be the more potent molecule, at least in HPV-negative patients.

A Shifting Treatment Paradigm in HNSCC

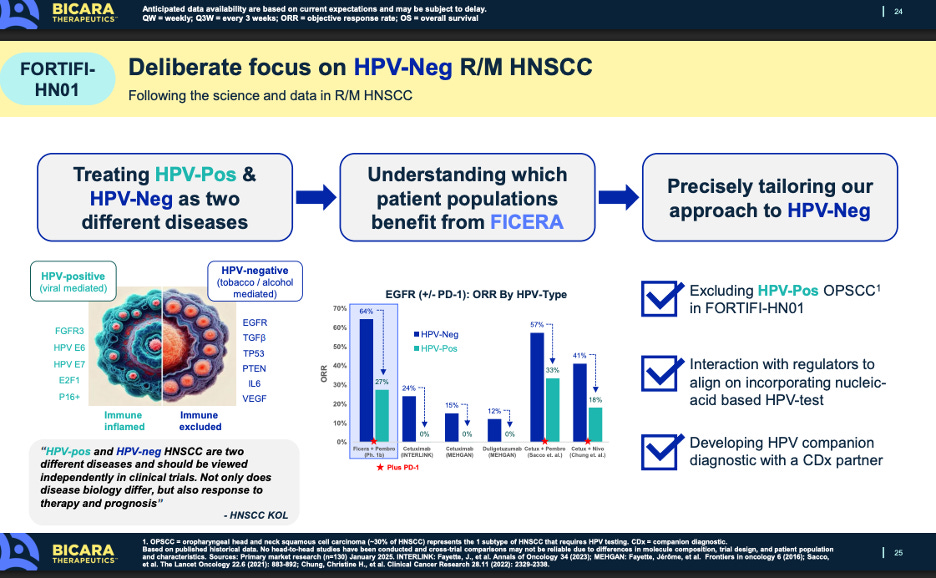

The other messaging point Bicara is making is its focus on HPV-negative patients only. HPV-negative patients tend to be worse off and have less immunogenic disease than HPV+ patients. More and more, treating physicians are starting to think of these subtypes as two distinct diseases, one that is viral mediated and another that is more carcinogen/lifestyle mediated.

Of course that is all very convenient for Bicara. Ficerafusp works way better in HPV-negative patients, so of course they would just look to focus on that segment. Weaker data in HPV-positive data gets swept under the rug, while Petosemtamab actually works well in both subtypes. That is certainly true, but we need to playout how the treatment of this disease may shift over the coming years. The treatment paradigm in this disease is being re-evaluated, because of the emerging data from Bicara, Merus, PDS, and other drug developers and how HPV status can meaningfully impact the course of disease. Without upcoming treatments in the pipeline that can make a meaningful impact on these populations, thought leaders aren’t necessarily pressed to think about how they could segment and sub-segment patients differently, and design an HPV-status defined treatment course. Up until now, the treatment paradigm has been bifurcated by PD-1 status but given the data we are seeing from Bicara and Merus, and importantly PDS too in HPV-positive patients, I predict we will see a wholesale shift in how treatment is managed in this disease.

I won’t go over the PDS data in too much detail. You can take a look at in the comparison table I shared earlier. But in short, PDS0101 is being studied only in HPV+ patients in the 1L setting, where it has shown a median overall survival of 30 months, which is quite impressive. Now fast forward a few years into the future when all three of these drugs are approved – what could the treatment paradigm look like?

The other messaging point Bicara is making is its focus on HPV-negative patients only. HPV-negative patients tend to be worse off and have less immunogenic disease than HPV+ patients. More and more, treating physicians are starting to think of these subtypes as two distinct diseases, one that is viral mediated and another that is more carcinogen/lifestyle mediated.