Speed, Scale, and Shifting Goal-Posts: What ASCO 2025’s Spotlight Trials Really Mean for the Next Wave of Oncology Players

Discussing a few interesting solid tumor data read outs to close out ASCO 2025 coverage

TRODELVY building and ownership position in TNBC but still a far cry from the $21B Gilead paid in 2020

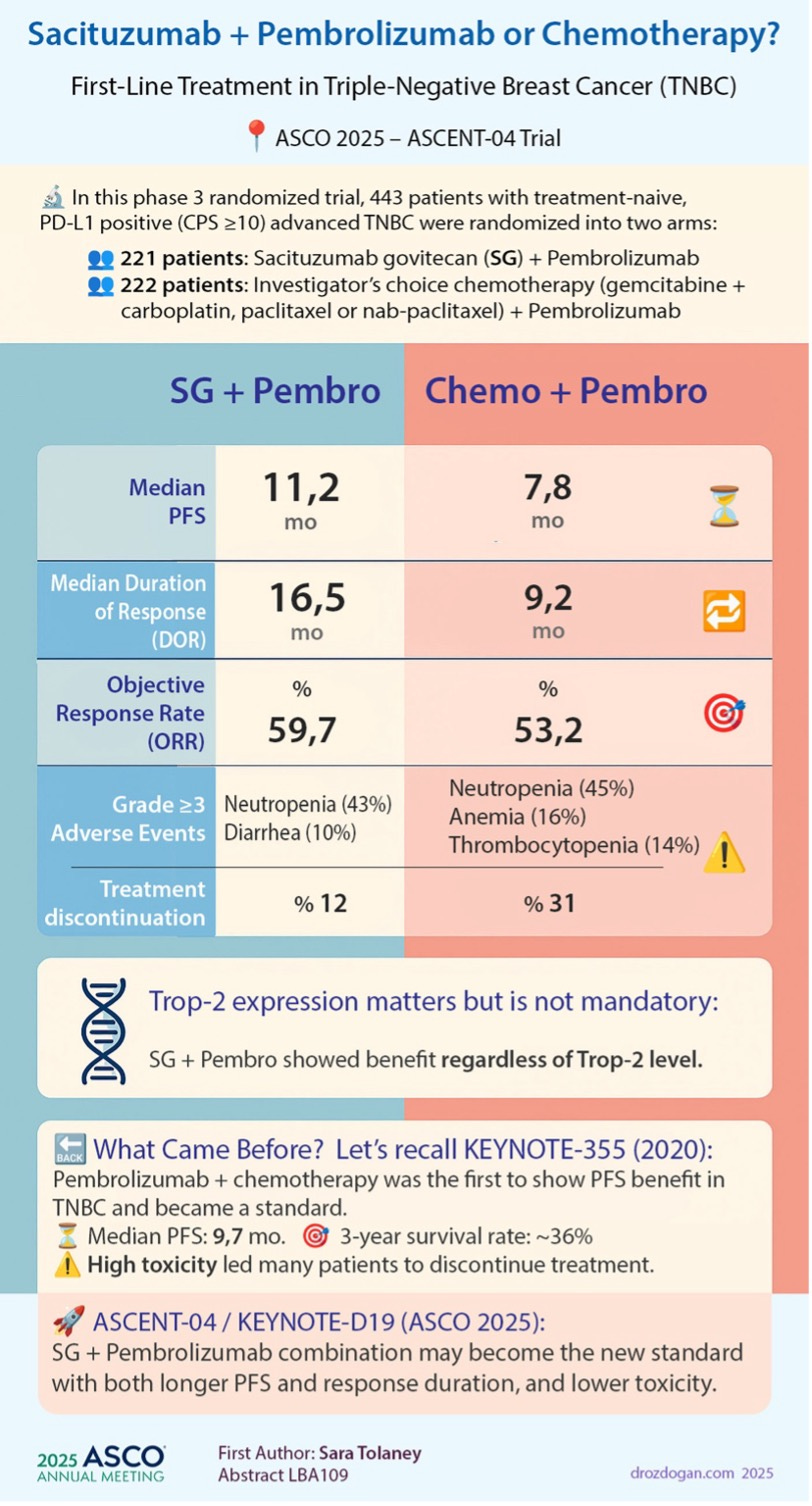

Gilead dropped a major TRODELVY data set in 1L TNBC, ASCENT-04, studying TRODELVY in combination with Keytruda (pembrolizumab). TRODELVY demonstrated superior mPFS (11.2 vs. 7.8 months) and mDOR (16.5 vs. 9.2 months) compared to Keytruda + chemotherapy in 1L mTNBC patients with PD-L1 CPS ≥10. ORR was 60% vs. 53%. Early OS analysis (26% maturity) showed a positive trend favoring the TRODELVY combination. Earlier in the month Gilead also toplined positive results in ASCENT-03, which studies PD-L1 negative patients in 1L TNBC, also showing a mPFS benefit vs. chemotherapy.

Many commented ASCENT-04 data was “practice changing”, and with TRODELVY now seemingly having lockdown on the 1L TNBC market, the forthcoming label expansion based on these two data sets will accordingly be “forecast changing” for TRODELVY. A big reason for this is how quickly TNBC patients can progress and die. Nearly half never make it to receive 2L treatment. With two data sets in hand an on track for approval in the 1L setting in 2026, Gilead can perhaps double the eligible treatment population for TRODELVY. All of that is positive movement for a drug that has run into many setbacks since Gilead’s $21B acquisition of Immunomedics back in 2020. TRODELVY commercial performance likely won’t ever justify that hefty price tag, those days are gone, but re-rating its potential to a consistent mid-low single-digit billions generator is the right move.

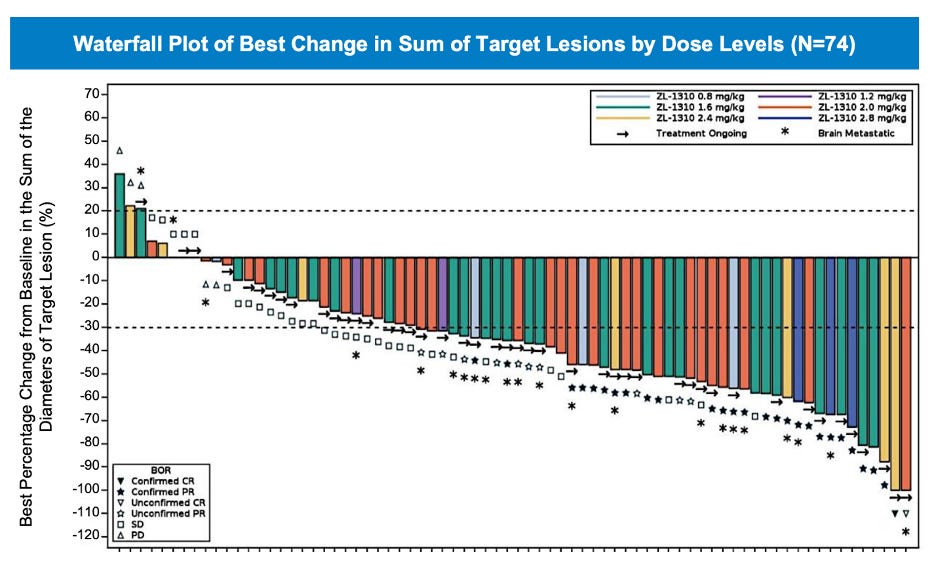

With TROP2 rival DATROWAY (AstraZeneca, Daiichi) has projected a readout from the Tropion-Breast02 study (PD-L1-negative, 1L) by June and another from the Tropion-Breast05 (PD-L1+, 1L) in 1H 2025, in-class competition is on the way. We cannot forget about Merck/Kelun’s MK-2870 either. At ASCO 2025, Kelun presented early results from the phase 2 OptiTROP-Breast05 study for sac-TMT as a first-line treatment in TNBC. In China, the drug showed a 70.7% response rate among 41 patients, lasting a median of 12.2 months. The median PFS was 13.4 months. For 32 PD-L1-negative patients, the response rate was 71.9%, with a median PFS of 13.1 months. Merck has a pivotal P3 (TroFuse-011) study in the 1L PDL1+ ongoing at western sites. This is a clear three-horse race in TNBC.