ASH 2025: Is This the Beginning of the End for Autologous CAR-T in Multiple Myeloma?

MajesTEC-3's historic efficacy, Kelonia's clean in vivo data, and Prasad's new superiority requirements create a perfect storm

Hello readers! If you’re reading this post in your email, it may get truncated by your email provider. Please hit “View entire message” so you can read the full post

The final day of the American Society of Hematology (ASH) meeting is always a good one because of late-breaking presentations. ASH 2025 did not disappoint, with two huge data readouts that seem poised to impact the treatment of multiple myeloma (MM) in the near and long-term.

This post will be free for a limited time. If you enjoy analyses, insights, and opinions about the BioPharma sector from an insider’s perspective, you can get access to all Big Pharma Sharma content by clicking the button below and becoming a paid subscriber. Thanks for your support!

MajesTEC-3 May Spell Trouble for CAR-T in the Near Term

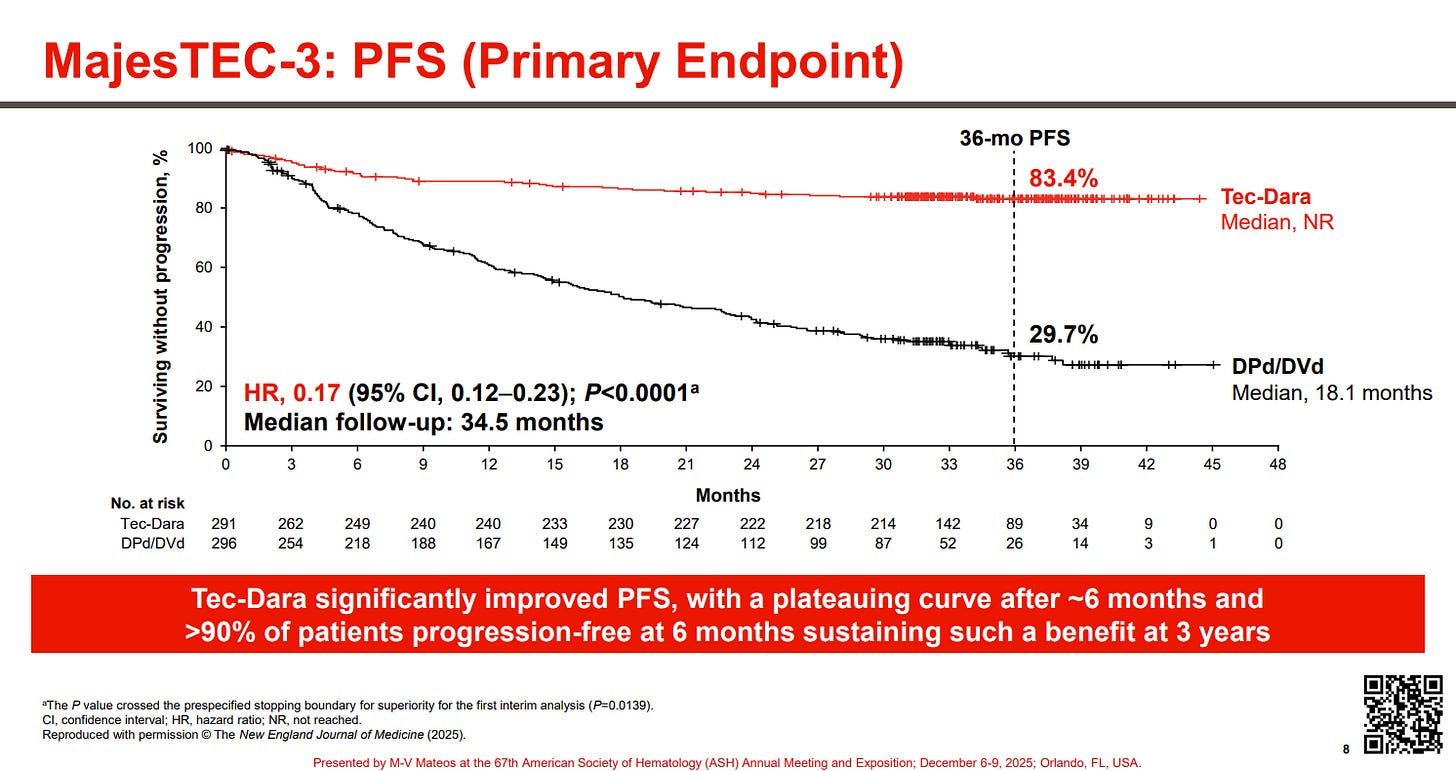

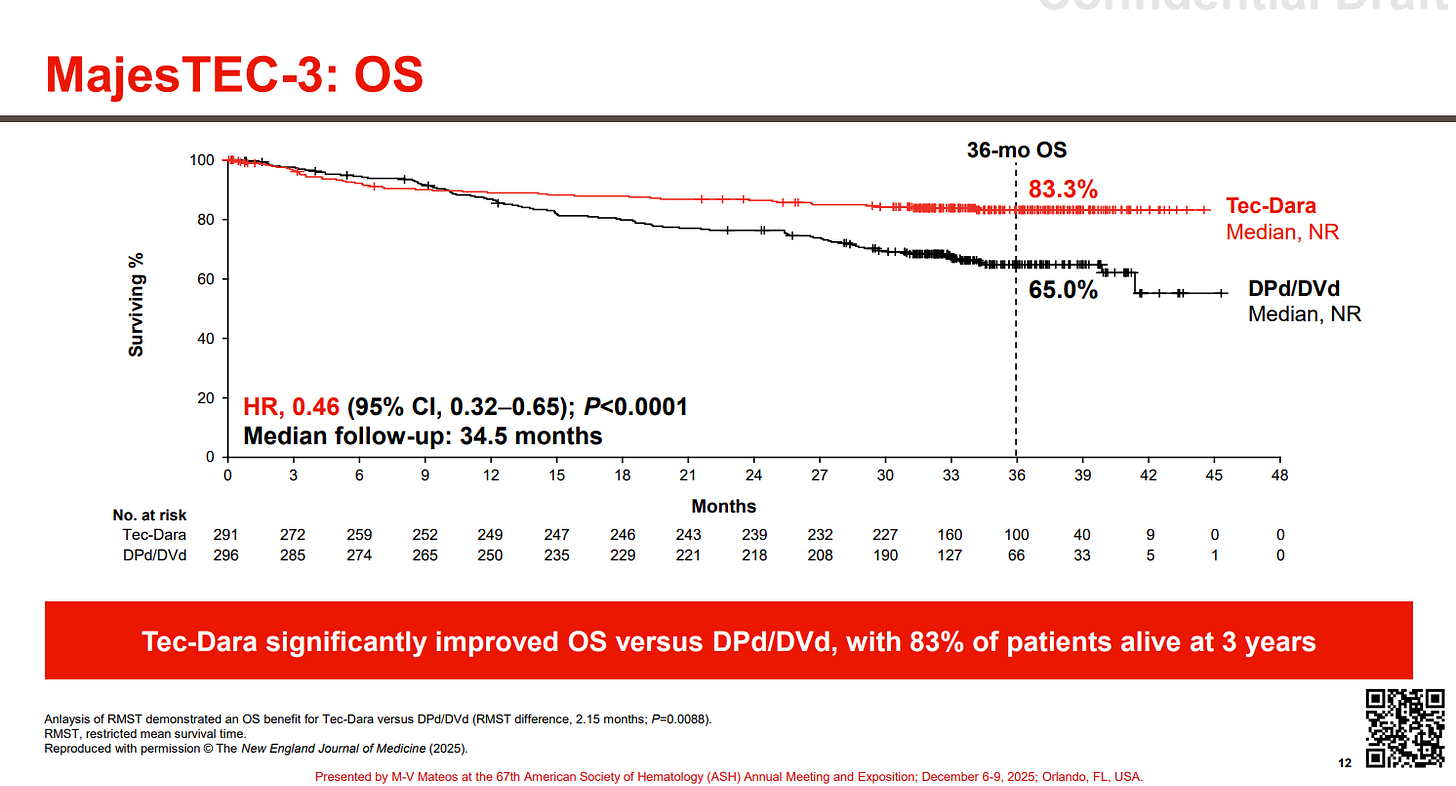

J&J JNJ 0.00%↑ arguably had the most jaw-dropping data at ASH with MajesTEC-3. The study examined a combo of DARZALEX (daratumumab, dara, anti-CD38 mAb) with TECVAYLI (teclistamab, tec, BCMAxCD3 TCE) vs. Standard of Care combo therapies (Dara + dexamethasone + pomalidomide OR bortezomib) in patients with 2L-4L MM. The results, across 587 patients, were concurrently published in NEJM, with J&J calling these results “unprecedented” and if you look at the survival curves, it is clear why.

A hazard ration of 0.17 is pretty insane and 83% overall survival at three years, with the curves seemingly flat-lining is equally insane.

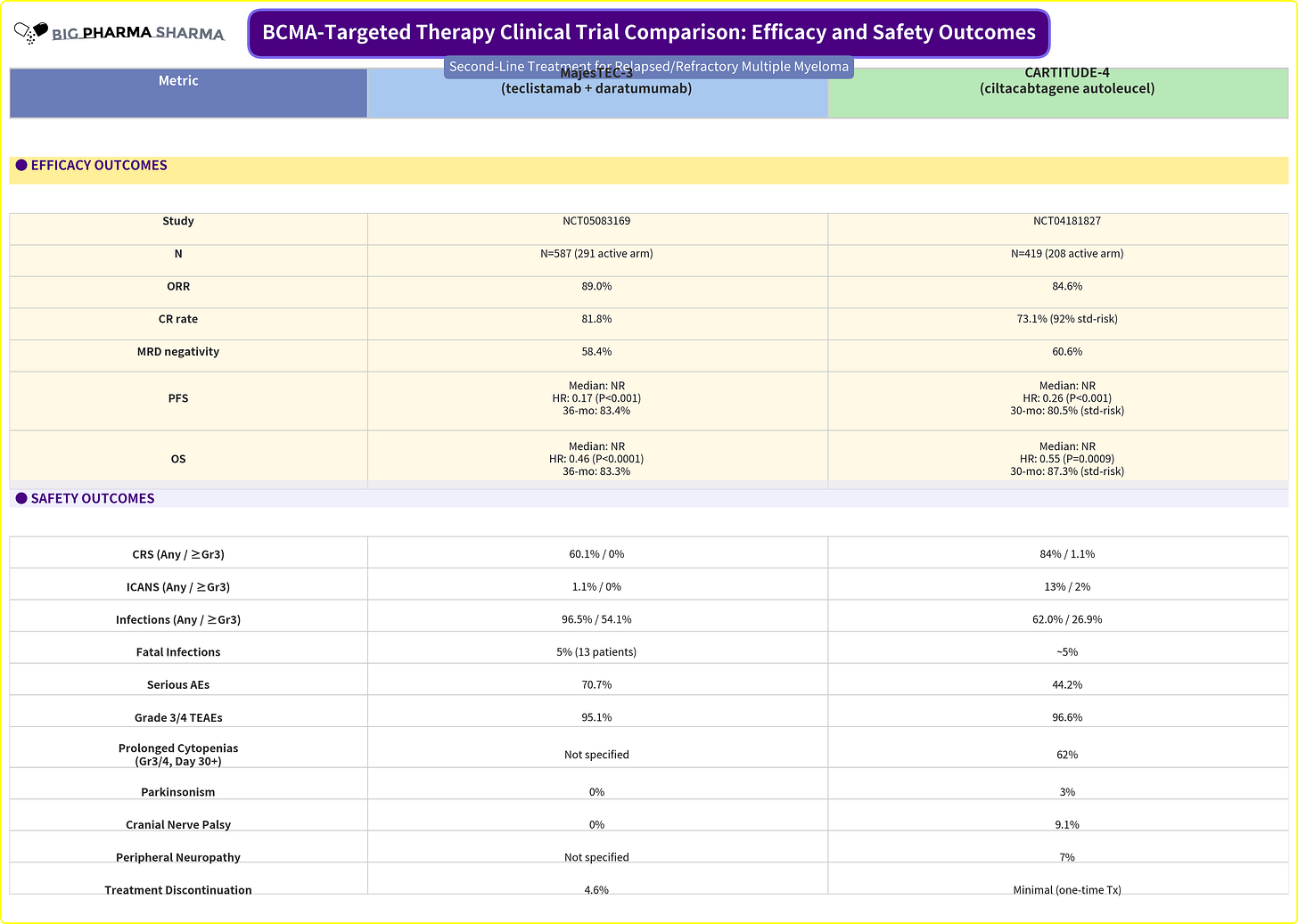

TEC is currently only approved in late-line (5L+) setting as a monotherapy in MM. If you’ve been following this space closely, you know that this 2L-4L setting is where JNJ, along with its partner Legend, already have CARVYKTI (BCMA CAR-T) approved via the CARTITUDE-4 study. J&J has now filed the DAR+TEC combo for FDA approval under the new real-time oncology review program. Approval of this new regimen would give J&J an option for every sort of patient in 2L+ multiple myeloma. CAR-T for those who can get it and DARA+TEC for everyone else.

Notably there were 5% of patients who died due to infections while on treatment, however after amending the trial protocol to reinforce IgG treatment and infection prophylaxis measures, only one infection-related death occurred.

What surprised me though is that when you look at the side-by-side between these two data sets, it’s really hard to see a difference between what you can get with DARA+TEC vs. what you can get with CARVYKTI alone. Efficacy-wise the combo looks on-par to slightly better than CAR-T. Safety-wise it looks to be better in the areas of most concern (CRS, ICANS, long-term cytopenias, and long-term neuro AEs). The infections are certainly concerning, but it seems as though being vigilant with prophylaxis measures can mitigate that

If you want to read the prevailing view as to why BCMA CAR-T is still better than this combo, you should check out Arcellx’s ASH 2025 investor event deck. The first section does a nice job laying out the CAR-T bull thesis in 2L+ MM in detail, but the broad strokes go a little something like this:

CD38 utilization in 1L MM is increasing significantly

MajesTEC-03 has no data in patients who are CD38 refractory

CD38 refractory patients do not perform as well on subsequent therapy in the 2L+ setting

TCEs have worse real-world safety and efficacy than CAR-T, especially with regards to infections and non-relapse mortality

The Arcellx folks draft a very fair argument, and in comparison to their product, anito-cel, they may offer a better risk-benefit trade-off when compared to DARA+TEC, whenever they generate comparable data to CARITUDE-4. At least in Arcellx’s ASH update in the potentially pivotal iMMAgine-1 study in late-line MM, anito-cell looks to be at minimum on-par to CARVYKTI in efficacy and better than it on safety. And like any study, even the best ones are not without their warts and inconveniences. 67% of patients needed to skip at least one TEC dose, roughly 29% needed dose reductions, and 33% needed to delay dosing due to an AE. This regimen will also require vigilant infection management and IgG supplementation, and these are some of the down sides of continuous treatment, in comparison to something definitive like CAR-T.

The key factor in Arcellx’s case against DARA+TEC is the patients who are DARA refractory. In MajesTEC-03 it’s 0%, but in CARTITUDE-4 it’s much more (roughly 20%). It begs the question, despite how transformational MajesTEC-03 data appears to be on its surface, how often will it get utilized if most patients are coming to 2L treatment already failing a prior CD38-based regimen?

I think there is nuance here that is worth exploring. CD38 is a weird target in that there is good evidence that it gradually recovers after patients are off DARA for some time. A physicians unwillingness to try another CD38 also is affected by the combo partner. Sometimes adding a new combo partner can reinvigorate response despite prior refractory status. Other physicians also consider the dose frequency of DARA.

Depending on whether you are transplant-eligible or ineligible in the frontline setting, you may get a different DARA-based regimen, with some requiring continuous treatment or maintenance, and others being a fixed treatment duration too. Perhaps the power of MajesTEC-03 will also influence how DARA is used in 1L - shifting to more fixed treatment duration to avoid DARA-refractory disease.

For what it’s worth, I think the prevailing evidence in cell therapy points to sequencing CAR-Ts ahead of bispecifics generally. You have less likelihood of driving treatment resistance and exhausting your T-cells. It’s better make your CAR-T product when your T-cells are the healthiest. There are also non-BCMA options, like GPRC5DxCD3 bispecifics that can rescue response if patients fail BCMA. The challenge is that even if getting CAR-T first is better, most community hospitals don’t have access to it (although that is growing), and we may see more patients who exhaust a BCMA bsAb option earlier in their care journey. I think this dynamic really adds pressure for cell therapy developers to move into the frontline setting, sooner rather than later with a definitive treatment option.

When we play this out at the commercial level though, I think it will be really hard for community physicians to ignore the strength of DARA+TEC. Community docs aren’t typically keen to refer their patients out of their care to get CAR-T at an Authorized Treatment Center (ATC), until they’ve exhausted enough options within their sphere of care. That’s why studies like Arcellx’s ACLX 0.00%↑ iMMagine-5 in the community setting, and continued on-boarding of larger community hospitals in the commercial setting are key to increasing CAR-T adoption at an earlier line of therapy. As management of AEs and comfort with out-patient use increase, this also makes adoption in community hospitals easier. Per Legend LEGN 0.00%↑ , CARVYKTI is actually available at 131 ATCs, 38 of which are community hospitals.

The immediacy of treatment will play a role here as well. Right now BCMA CAR-Ts still take a month vein-to-vein. Arcellx and Kite will likely shrink that to 17-days or less if/when they launch. There is still an inordinately high percentage of patients who still require bridging therapy with BCMA CAR-T as well and while manufacturing capacity continues to increase, centers still complain about finding manufacturing slots. Being able to treat a patient right away and preserve CAR-T for later would seem to be the initial dynamic that sets in as community penetration slowly increases.

I am curious to see how Legend and J&J message CARVYKTI now. Perhaps there will be differences in how both commercial teams approach that, with the Legend team needing to perhaps adopt some of the counter-messaging the Arcellx team has already put forth.

Early In Vivo BCMA CAR-T Data Looks Good!

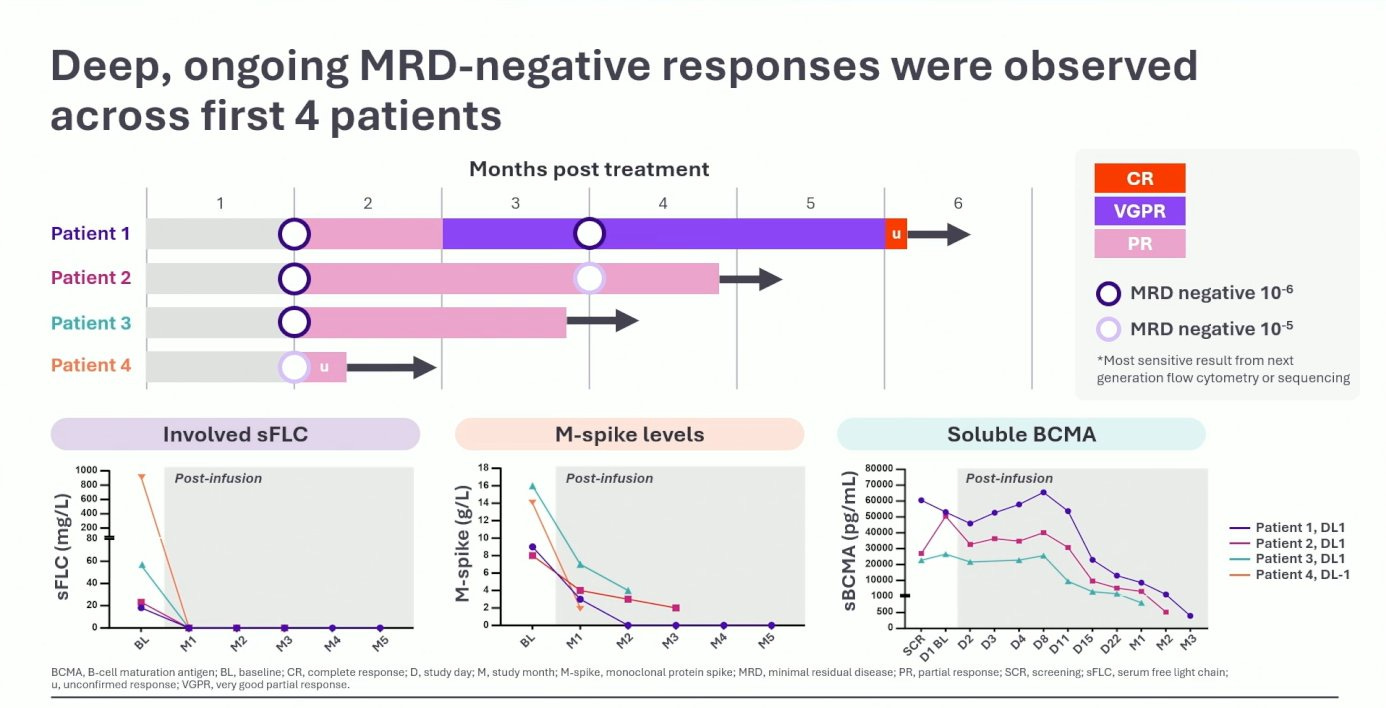

The other myeloma late-breaker was from Kelonia (another J&J affiliated company; they didn’t become the leader in myeloma just by sitting around you know) who shared first clinical data of its in vivo BCMA CAR-T, KLN-1010.

The data set was quite small, just four 4L+ patients, which is not usually big enough to get the late-break stage at ASH. That fact that it did tells you how excited people were for these results.

All four patients achieved MRD-negative response, with the patients response deepening to CR at 6-months. Notably the AE profile showed no ICANS, CRS G1-2, and no delayed neurotoxicities. Expectedly, the cytopenia profile was quite low as well, given in vivo CAR-Ts are not administered with lymphodepletion.

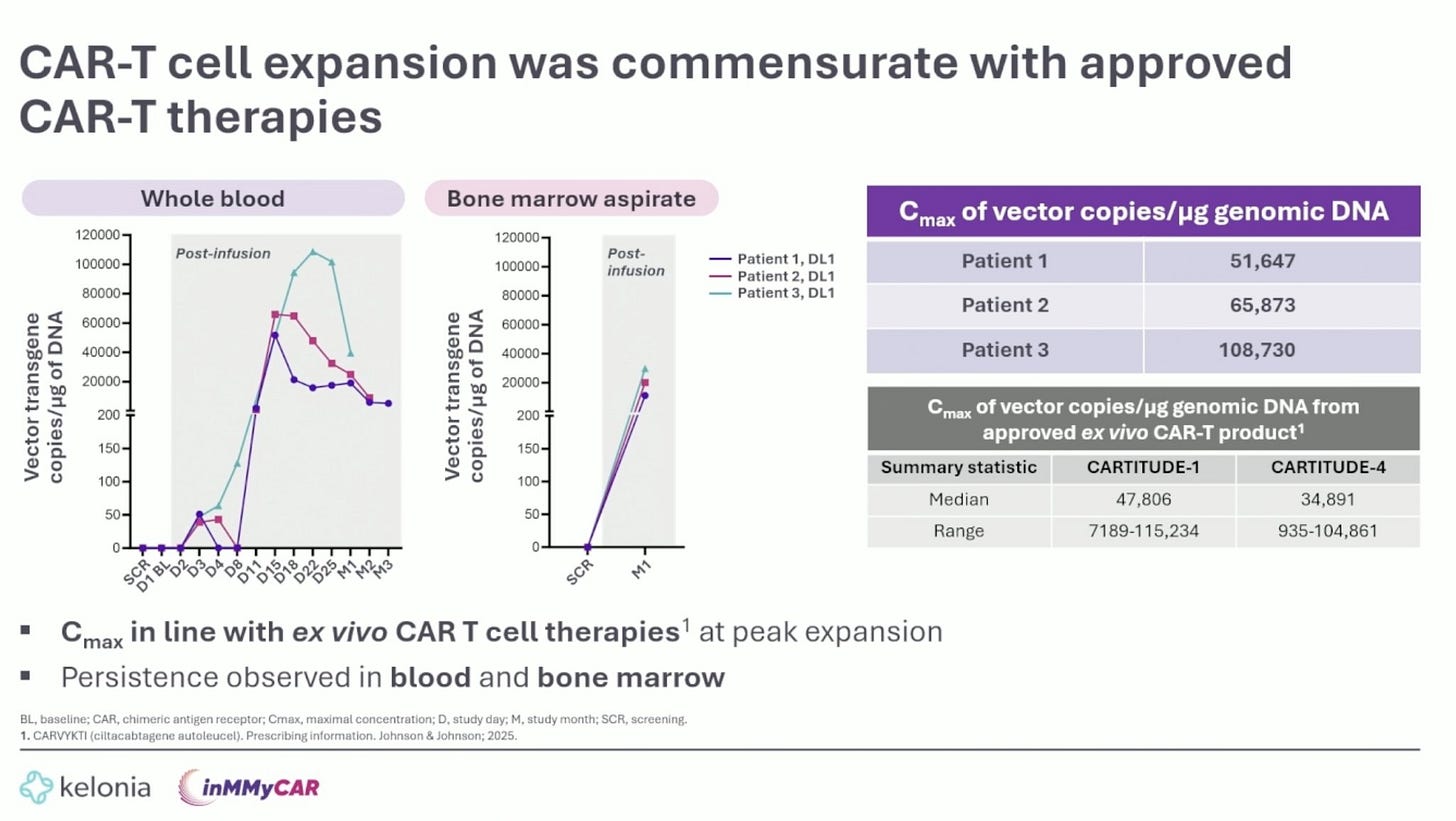

Look, it is still early days with in vivo CAR-Ts, but these results (at lower dose levels) are certainly encouraging. As more patients get treated, it will be important to see how many responses can convert to CRs. Kinetically, it was good to see Cmax being in line with CARVYKTI, suggesting that this product may have enough horsepower to generate persistent responses.

In heme/onc, if in vivo meets the CARVYKTI efficacy bar, continues to show a more moderate safety profile, and avoids long-term AEs, it means CAR-T will have entered the final stages of evolution. That’s a big reason why auto BCMA CAR-T stocks were down after these data (and the Majestic-03) abstracts were released. The Kelonia data shows that in vivo remains on that course, for now.

Vinay Prasad Wants to see Superiority in CAR-T Studies

During ASH, we got word that Vinay Prasad, the controversial CBER director, delivered some revised guidance on what he would like to see for CAR-T studies moving forward in JAMA. The tweet above from Ned Pagliarulo does a nice jobs summarizing the key points. Prasad wants to see RCTs with survival endpoints for earlier line settings. Single-arm studies could still be ok for late-line therapy or rare diseases. He also wants to see superiority studies against current CAR-Ts, and is perhaps only situationally interested in equivalence or non-inferiority vs. auto CAR-Ts.

On the surface this doesn’t feel a whole lot different than what precedent has been. Single-arm studies for settings without established SoC and RCTs with survival endpoints for earlier line settings have been the norm so far and what leading companies like Kite have done to advance Yescarta.

There are some potential questions to consider here though:

Do new CAR-Ts now need to go h2h vs. commercial CAR-Ts? If so, how do you run that study as a small company? Are you paying Gilead, BMS, JNJ, etc. to mfg. their commercial CAR-Ts? Reimbursing patients for commercial CAR-T? Either way that can get very expensive very fast. Will FDA let you go up against non-CAR-T SoC instead?

Companies like Lyell are already doing this it seems with its P3 study of Ronde-Cel (CD19/20 CAR-T) vs. commercial CD19 CAR-Ts. Credit to Lyell for dishing out the capital and taking on the risk to go head-to-head against commercial CAR-Ts. As I wrote a little while back, this was a choice other companies, for example Caribou, chose to eschew, perhaps due to the heavy financial lift. Lyell is unique in some ways, in that they have always been able to raise loads of capital, since its inception. I’m not sure there are too many small companies who have the finances to take on a challenge like this. Going up against YESCARTA and BREYANZI is surely a high bar, but if it pans out, it is really powerful data that would show clear superiority.

If superiority studies will be the preferred and non-inferiority seemingly more difficult (reading in between the lines of Prasad’s comments), in vivo CAR-Ts could be negatively impacted, depending on how efficacy is measured. Thus far efficacy has looked nominally lower (still early), but the advantages of immediate treatment are important in the current state of cell therapy. If measuring efficacy by ITT vs. mITT (only patients who make it to auto CAR-T), perhaps this favors formats like in vivo.

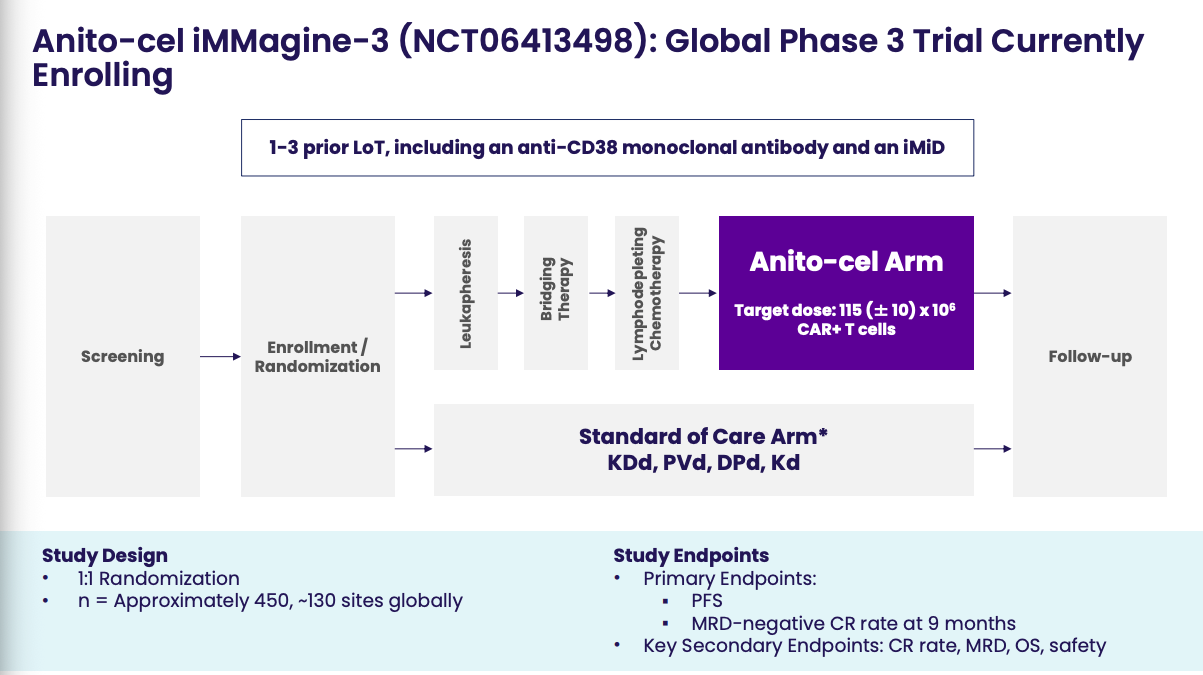

Furthermore, what does this new guidance mean for companies like Arcellx who are already at the proverbial goal line with anito-cel in a single-arm P2 study design? The good thing is they do have their confirmatory Phase 3 study ongoing (iMMagine-3), which looks to mimic CARTITUDE-4. With how capricious and unreliable this FDA seem to be though, I wonder if they will find this study design to be insufficient. Perhaps Prasad & Co. want to see anito-cel vs. TEC+DARA. Perhaps they demand Arcellx and Gilead include CARVYKTI in the comparator arm.

There is palpable regulatory risk here for me that wasn’t there before. Given how this FDA handled similar cased like Uniqure QURE 0.00%↑ and Replimune REPL 0.00%↑, I have difficulty raising my confidence level to 100% that this FDA will play ball with the company’s regulatory plan. I am hopeful that they do. As I’ve written and stated before in the case of Replimune, it would be unfair for the FDA to hold companies like Arcellx who are already far down the accelerated + confirmatory approval path to new guidance that would further delay commercialization of a promising treatment, like anito-cel. But these days, you just never know. Both companies are doing and saying all the right things to reassure stakeholders, and I’m hopeful that this fear of mine is misplaced.

So is this really the beginning of the end?

It’s probably too early to say definitively. However, the combination of the great MajesTEC-03 data, strong early in vivo BCMA CAR-T clinical signal, and new regulatory scrutiny should collectively raise the alert level for autologous CAR-T players that are relatively advanced, like Arcellx. The competitive landscape just got significantly harder, and the regulatory goalposts appear to be moving. There are still important cards left to play—community adoption data, 1L studies, and commercial execution will all matter tremendously. But the threats are real, both near-term and long-term, and companies that underestimate this convergence do so at their own peril. The autologous CAR-T story isn’t over, but it just got a lot more complicated.

Should we also be talking about allogeneic CAR-Ts? They are still a viable competitor, especially Allogene which has a 1L high-risk trial ongoing that can solve many of the issues highlighted here.