Galapagos Hits Reset with Spinout: Gilead Gets a Do-Over?

Galapagos NV, the Dutch biotech that's been more synonymous with disappointment than discovery in recent years, is shaking things up. The company is spinning out its small molecule pipeline into a new entity (aptly nicknamed "SpinCo" for now) while the remaining Galapagos will focus solely on cell therapies for cancer treatment. This move comes as Galapagos attempts to revitalize shareholder value, reduce cash burn, and streamline its operations. But the real intrigue lies in what this means for its long-time partner (and sometimes-sugar daddy), Gilead Sciences.

My heart goes out to all those affected by the devastating fires in the Los Angeles area. Having grown up in SoCal, I know how destructive fires whipped up by the Santa Ana winds can be. These events seem to be increasing in devastation. Like many of you, I have friends and colleagues who have been impacted. Please reach out to them and ask how you can help. If you are looking for ways to support wildfire victims, here are a couple of articles highlighting organizations that are helping (see ABC and TIME). As with any organization highlighted during natural disasters, it's important to do your own research before donating.

Galapagos and Gilead: From Whirlwind Romance to a Bitter Divorce?

Let's rewind to 2019. Galapagos and Gilead inked a 10-year R&D collaboration that seemed like a match made in heaven. Gilead, flush with cash from its HCV franchise, was looking to bolster its pipeline, and Galapagos, with its novel target and drug discovery platform, seemed poised to deliver. The deal involved a hefty $3.95 billion upfront payment and a $1.1 billion equity investment from Gilead, giving them exclusive rights to Galapagos' pipeline outside of Europe. Gilead also gained two seats on Galapagos' board of directors, giving them considerable influence over the company's direction.

The honeymoon phase, however, was short-lived. The FDA delivered a crushing blow by rejecting filgotinib, Galapagos' lead JAK1 inhibitor, due to testicular toxicity concerns. This was a major setback for both companies, as filgotinib was the centerpiece of their collaboration and a key potential growth driver for Gilead. Other pipeline disappointments followed, including the discontinuation of ziritaxestat for idiopathic pulmonary fibrosis, and the partnership appeared to be on the path to fruitlessness.

The Galapagos-Gilead partnership has undergone several amendments over the years, reflecting the evolving dynamics of their relationship. In 2020, Galapagos assumed full responsibility for the development, manufacturing, and commercialization of filgotinib in Europe. This shift suggested a desire for Galapagos to have greater control over its key asset in its home market, potentially signaling a growing rift between the two companies.

With this spinout, it seems like Galapagos and Gilead are finally heading for a divorce. The original licensing deal, which covered all of Galapagos' small molecule programs, will transfer to SpinCo. This essentially frees Galapagos from its obligations to Gilead and allows it to focus solely on its cell therapy ambitions.

Galapagos' Pipeline: Doubling Down on Cell Therapy (and Decentralized Manufacturing)

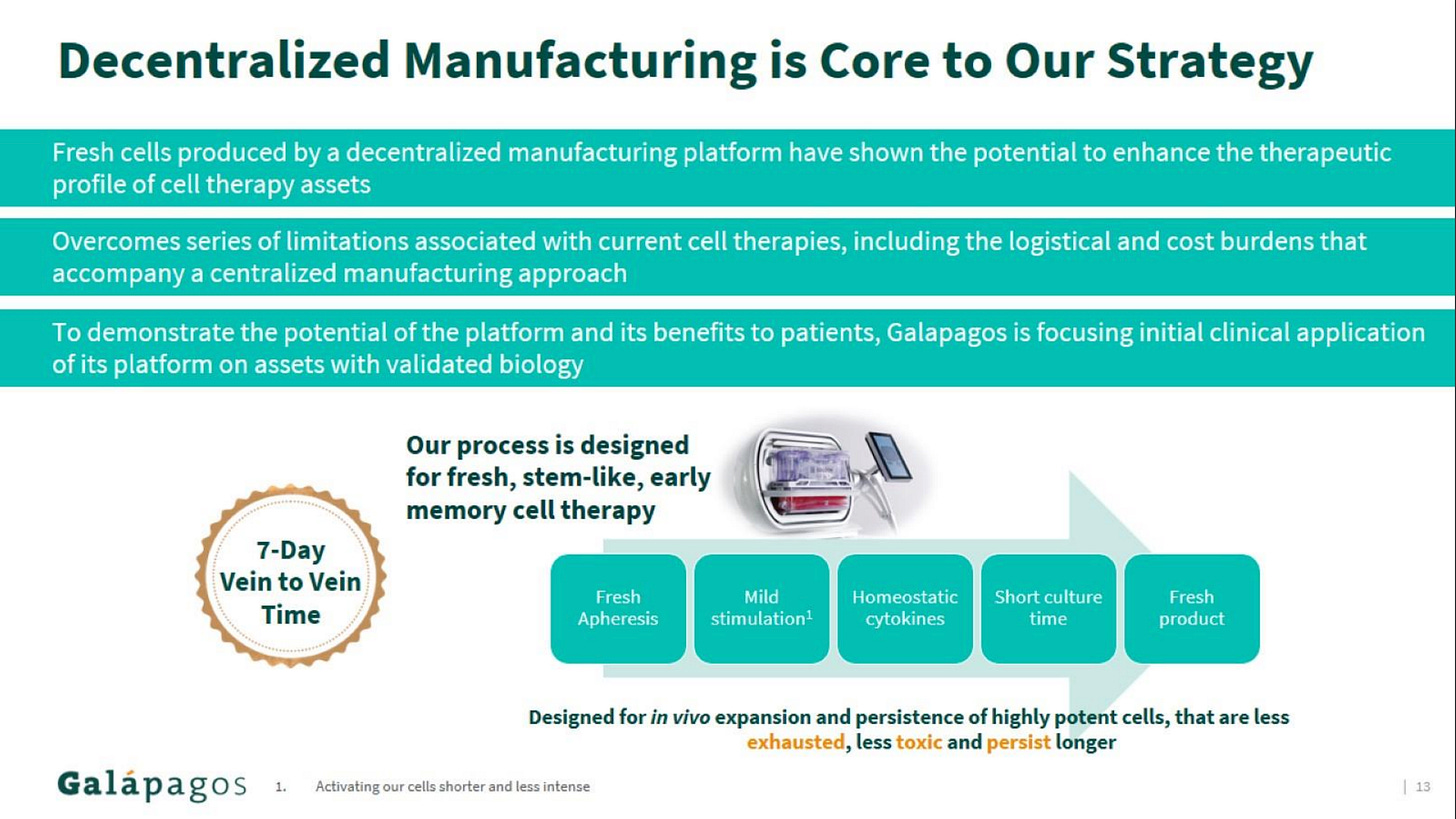

Galapagos' current pipeline is a mixed bag, with a primary focus on cell therapies for cancer treatment. They're developing CAR-T cell therapies targeting CD19 and BCMA for various blood cancers, utilizing a decentralized manufacturing platform that aims to improve patient access (note: I covered this approach in more detail in my ASH 2024 review). This decentralized approach involves establishing manufacturing units closer to treatment centers, potentially reducing production time and logistical challenges associated with traditional centralized manufacturing. Galapagos has partnered with Blood Centers of America to leverage their nationwide network of collection and donation centers to support this decentralized manufacturing strategy.

But with this spinout, Galapagos is essentially waving the white flag on its small molecule ambitions, seeking other partners to take over those assets. This strategic shift towards cell therapy specialization is likely driven by several factors: