GenMab's Halloween Costume and NK stands for 'Not Keeping' at Takeda

Some weekend takes from two big stories this past week: GenMab acquiring Merus and Takeda shutting down all their cell therapy programs

There were two interesting news items this week that I wanted to provide my thoughts on. Neither of them were worth a full post each. I thought about just tackling these via posts on X and Notes, but instead decided to combine them into one short post.

Let’s get into it!

GenMab’s Halloween Costume

The News: GenMab acquired bispecific antibody developer, Merus, for $8B (41% premium), adding petosemtamab (EGFR x LGR5 bsAb) which is in pivotal studies in 1L and 2L head & neck cancer.

So I’ve discussed Merus’ petosemtamab (peto) before and the interested race that is forming in the head & neck squamous cell carcinoma (HNSCC) space. I am not at all surprised Merus got acquired. Given peto it is a late stage oncology asset, with P3 data expected in 2026 (implying a potential approval in 2027), I would have guessed it would be one of the big fish in our industry doing the acquiring. An $8B acquisition for a late-stage asset is the sort of deal a Big Pharma does to plug-up a patent cliff. Instead, we saw a mid-size player with roughly $3B in cash raise $5.5B in debt to go out and do this. We got a glimpse of what GenMab is wearing for Halloween, and guess what? It’s a BMS costume.

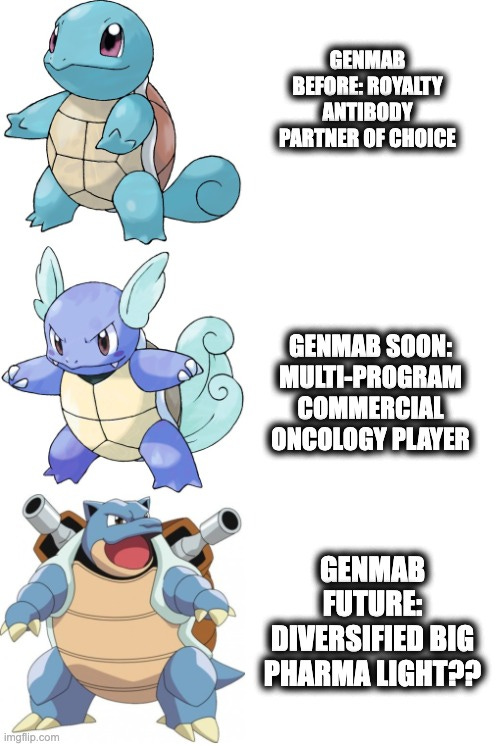

I like this move a lot for GenMab. Not just because peto looks like a good drug that has a strong chance of approval in a disease where patients where patients do not have a whole lot of options outside of chemotherapy and PD-1 antibodies (check out my previous post where there is a nice data comparison table). The move fits with a larger strategic shift the company has been making for the past several years. For the longest time, GenMab was an antibody partner of choice for Big Pharma. Those partnerships led to some incredibly successful drugs and equally successful royalty streams, largely from J&J and best-selling multiple myeloma drug, DARZALEX.

On the surface, this is a nice business model if you can get it. Crank out great antibodies and let your Big Pharma partners do the work of commercialization, while you count your royalty checks. However, the other side of the coin here is that as a company you are really at the whim of your current partners and your ability to find future partners. Your revenue streams are entirely out of your control and building a sustainable business requires a high clinical and commercial hit-rate, with the commercial part being the part you have very little say in.

GenMab realized this a few years ago and set out to diversify its revenue streams, pivoting to retaining commercial rights for its programs but focusing in Oncology. I’m sure the impending patent cliff for DARZALEX (potentially 2029) also accelerated this thinking quite a bit. Successful launches of TIVDAK (co-commercialized with Pfizer/Seagen) and EPKINLY (Co-commercialized with AbbVie) got them the commercial reps they needed and now the company feels they are ready to go it alone. The acquisition of Merus is the capstone to this maturation, but those in the know will tell you the forbearer to this was its $1.8B acquisition of ADC company Profound Bio. That deal brought-in Riva-S ( FR-alfa ADC for gynecological cancers) that is set to compete with AbbVie’s ELAHERE starting in 2027.

So it’s clear to me GenMab’s longer-term vision is to be a diversified Big Pharma type player, but in the short-run, can they get to a healthy interim stage? The Wartortle to their Blastoise evolution goals?