Is Cell Therapy "Out of Favor" or Undervalued?

Why progress suggest investors are abandoning solid tumor cell therapy too early

Hello readers! This week's edition is a little bit of a different flavor, as I decided to call in some reinforcements. I had the pleasure of co-authoring this piece with my colleague, Derrell Porter. If you know Derrell, you know he shares my passion for Cell Therapy and its transformative potential - so the topic of today's piece is something we are both very passionate about. Hope you enjoy!

We are in an era of unprecedented change and upheaval in the scientific and medical community, with federal funding challenges, FDA leadership shifts, and financial market uncertainty and malaise combined with scientific uncertainty. You see this reflected in the public markets with the XBI at roughly 40% below its peak in 2021. These dynamics have presented a particular challenge for the emerging biotech landscape with some areas harder hit than others.

This post is free to all, however if you enjoy analyses, insights, and opinions about the BioPharma sector from an insider’s perspective, you can get access to all Big Pharma Sharma content by clicking the button below and becoming a paid subscriber. Thanks for your support!

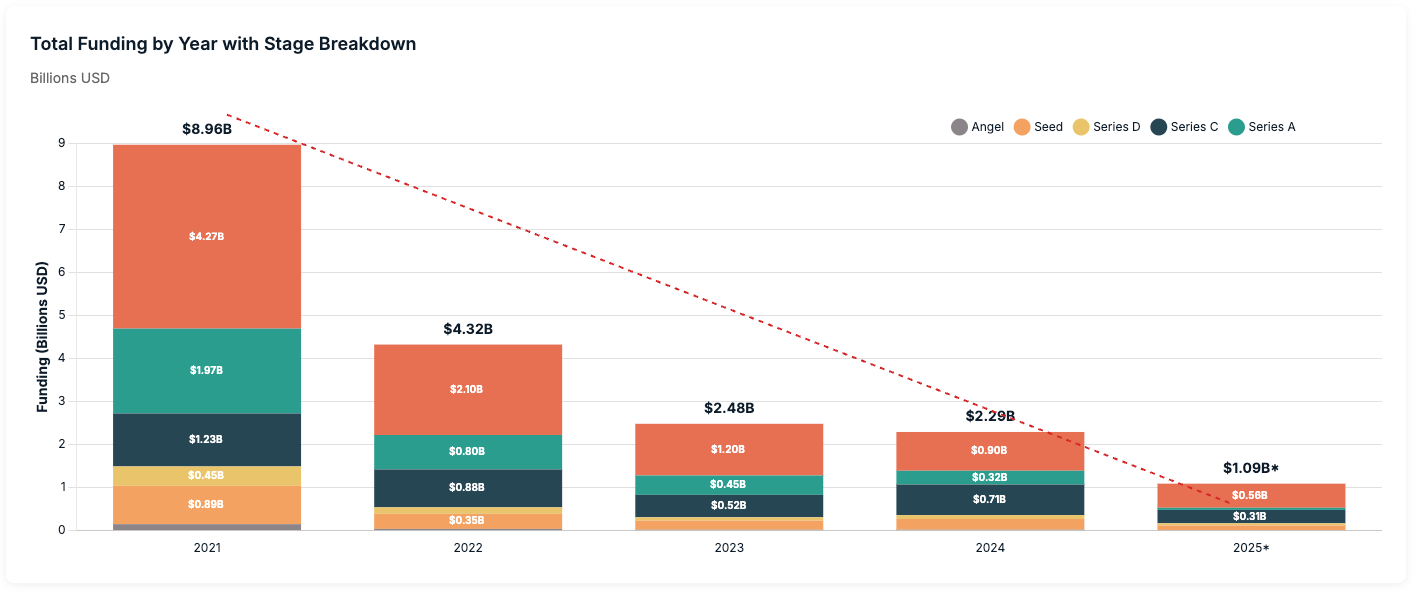

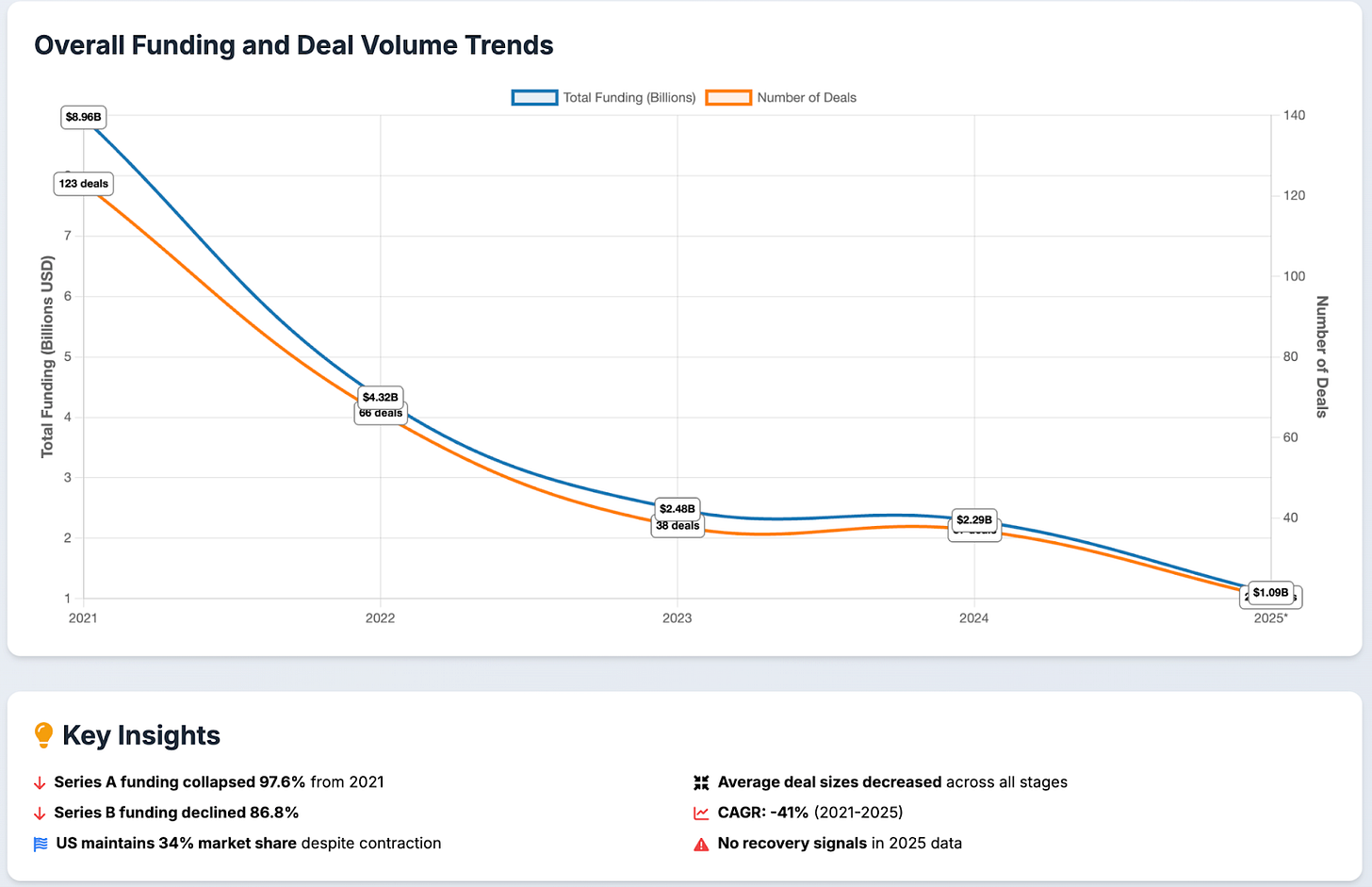

Cell therapy has been particularly hit hard, now being characterized as being an “out of favor” modality by investors. Many companies are filing for bankruptcy, laying off staff, merging, or simply abandoning the field completely. Commensurately, new company creation has collapsed. What was once a booming bastion of VC dollars has now seen few and far between. Total funding into cell therapy companies was roughly $9B in 2021 and has steadily declined, with annualized numbers at roughly $1B for 2025. We have seen a collapse in the number of funding rounds as well, most notably in the earlier Series A and B stages that are a fraction of what they once were.

What is masked in this downturn is the tremendous scientific, manufacturing and medical progress that continues to be made in the broader field of cancer therapeutics. Cancer treatment encompasses both established therapies—radiation, chemotherapy, targeted agents—and emerging modalities like bispecific antibodies, ADCs, mRNA vaccines, and radioligand therapies. Yet cell therapy remains one of the few approaches offering curative potential. We know this intimately, having lived the highs and lows of this field as experienced cell therapy executives who have spent nearly the last decade endeavoring to fully realize cell therapy’s promise and potential in solid tumors.

So how did we get here? How did we get to the place where a technology that has the power to cure solid tumors has fallen “out of favor”? And more importantly, what needs to happen to prevent progress from falling through the cracks?

The Overcrowding, Stumble, and Eventual Success of Heme CAR-T’s

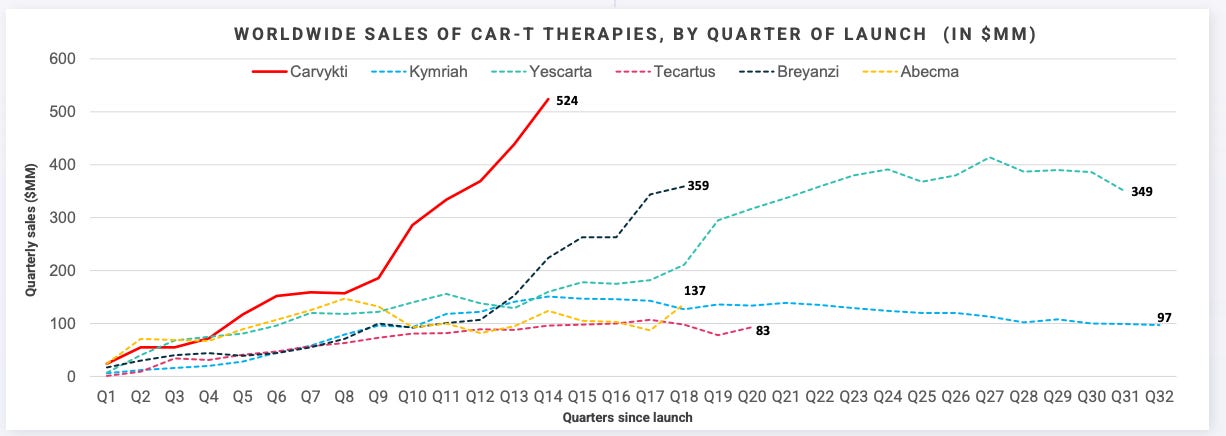

The first CAR-T therapies targeted CD19 for B-cell malignancies and were brought to bear by partnerships between pioneering biotechs and leading research institutions. Kite with the NCI, Novartis with UPenn, and Juno with Sloan-Kettering and Fred Hutch, worked swiftly to accelerate these programs through clinical trials in record time. On August 30th, 2017, Novartis’ Kymriah became the first CAR-T therapy to achieve US approval, initially in pediatric acute lymphoblastic leukemia (ALL). Not too long after, Kite won approval of Yescarta for DLBCL on October 18th, 2017. From IND to approval Kymriah and Yescarta only took roughly 5 and 3 years, respectively - a testament to the curative potential showcased by both these products throughout its clinical journey.

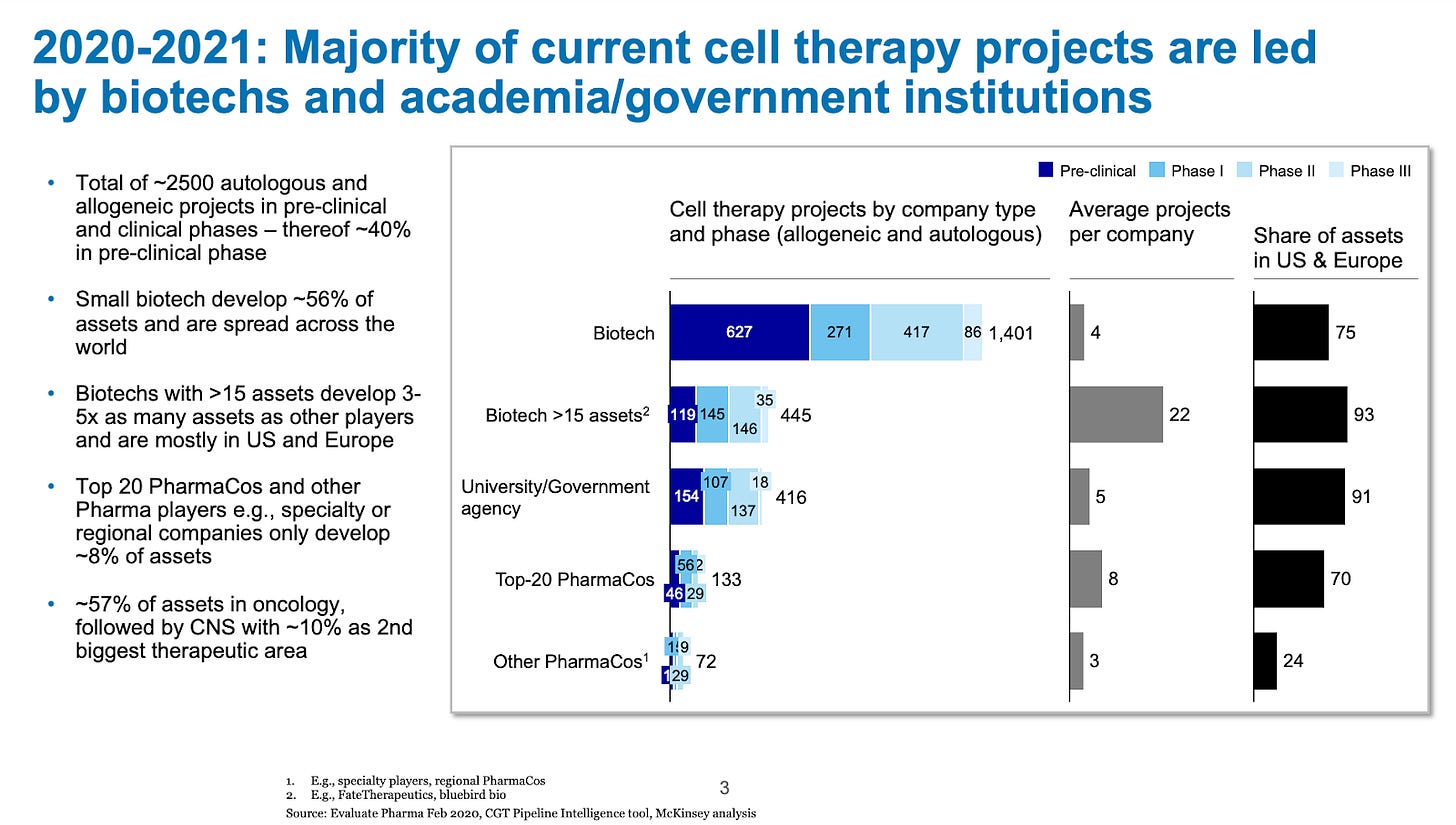

This was a magical moment in the history of cell therapy - a therapy that cured cancer was now commercially available to patients. As is well chronicled, Emily Whitehead was the first pediatric patient treated with a CD19 targeted CAR T (what ultimately became Novartis’ Kymriah) for ALL. In 2022, she celebrated 10 years being cancer-free and in 2024-2025, many investigators called her “cured”. The promise and potential led to an explosion in interest in the field, with up to 2,500 cell therapy projects in development in the early 2020’s (2020-2021).

But what gets under-appreciated about bringing an entirely new therapeutic modality to market is the blocking and tackling required to commercialize and achieve the requisite scale. It is fair to say that these two initial products struggled right out of the gate with complicated deliveries, manufacturing failures, slow academic center training and approval. Ultimately, they did not meet revenue expectations in the early years of the commercialization. Over time the CAR-T market grew meaningfully as new BCMA targeting CAR-Ts came on line and the forerunning CD19 CAR-T class expanded into earlier lines of therapy, leading to Kite/Gilead’s YESCARTA and Legend/J&J’s CARVYKTI becoming blockbuster products with annual sales >$1B.

Despite this status, for much of the CAR-T class (all but CARVYKTI) sales have begun to flatline recently. The reasons for this are multi-faceted. Competition from the non-cell therapy class has eroded CAR-T market share, especially from the growth of the bispecific class, which offer strong (albeit likely not curative) efficacy, safety, and immediate treatment potential and a more site of care, making this class better suited for community hospitals where a significant amount of the heme/onc market exists. Additionally, incremental advances and novel cell therapy approvals that could have continued to advance the scientific frontier have slowed. Cell therapy has effectively ceded market share to competitive classes in oncology and/or pivoted to other diseases (e.g. autoimmune diseases) and other approaches such as in vivo CAR T.

So while CAR-Ts do offer curative potential in certain heme/onc diseases, the competitive dynamics they face, along with the manufacturing/logistical barriers, protracted time to treatment, and narrow patient eligibility limit the ability to address the unmet need that still remains.

The Solid Tumor Cell Therapy Challenge: Targeting isn’t Easy

While hematologic cell therapies have achieved commercial success, translating these advances to solid tumors has proven challenging—until now. The key obstacle is target complexity. Heme malignancies present single, stable targets like CD19 or BCMA that are expressed across the entire tumor and healthy tissue that regenerates easily. In the case of B-cell lymphoma, every B-cell in the body will express CD19, malignant or otherwise. If one can eradicate everything that has CD19 surface marker, the tumor is removed as well. Once healthy B-cells regenerate, a patient can go on to live a normal cancer-free life. Solid tumors display multiple unstable targets that shift over time, allowing tumors to evolve and evade single-antigen therapies. Moreover the universally expressed single extracellular antigens one would typically target with a CAR-T also reside on healthy tissues that won’t regenerate so easily, leading to significant toxicity risk.

You either need to target the wide swatch of these unstable tumor-specific targets, or zero-in on one that is highly expressed in a select sliver of patients. Two solid tumor cell therapies demonstrate how to overcome this: Iovance’s Amtagvi (approved) and Immatics’ IMA203.

Approved February 2024 for metastatic melanoma, AMTAGVI takes a patient’s own tumor-fighting immune cells (TILs), expands them by the billions outside the body, then infuses them back. Unlike CAR-Ts that target one antigen, these naturally-occurring cells recognize multiple tumor targets simultaneously—making it harder for cancer to escape.

IMA203 engineers T cells to hunt intracellular cancer proteins that CAR-Ts can’t reach. By targeting PRAME—a cancer-testis antigen hidden inside tumor cells—it expands what’s druggable beyond surface proteins. The manufacturing process and administration are pretty much the same as CAR-T, the only catch is that the targeting modality is a TCR, which means it is HLA-restricted. This means that only patients with a specific HLA-type (in this case HLA-A2) can receive this treatment.

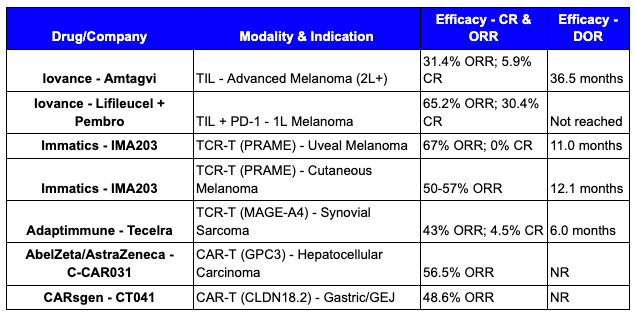

ICYMI Cell Therapy for Solid Tumors Works

One of the most critical measures of a treatment’s effectiveness is called Complete Response rate or CR’s. It is a subset of the Objective Response Rate (ORR), which includes both Complete Response (CR) and Partial Response (PR) and one of the most commonly used metrics for the effectiveness of a cancer therapy. When you can completely eliminate a cancer, there is a better chance it never comes back - i.e. leading to greater progression free and overall survival.

The early innings of solid tumor cell therapy have proven fruitful, representing a meaningful advance for patients who have no other treatment and options. While the logistics and manufacturing advantages of other approaches is well documented, the ability to generate high response rates and in some applications meaningful CR rates, should not be ignored. Most solid tumor doctors, save a couple tumor types, aren’t even accustomed to seeing complete responses in their patients at all with the most advanced non-cell therapy modalities like ADCs and bispecifics.

Importantly, this is just the beginning. The efficacy of these base profiles can further be tuned up with the programmable enhancements that overcome key solid tumor barriers or combination with other therapies. The data to date shows a clear signal and we have the toolbox of enabling technologies (gene editing, cytokine modules, anti-TME elements, etc.) to continue driving up the CR rate in these tumor types and others that have yet to be tapped.

The Investment Imperative: Don’t Abandon the Final Mile

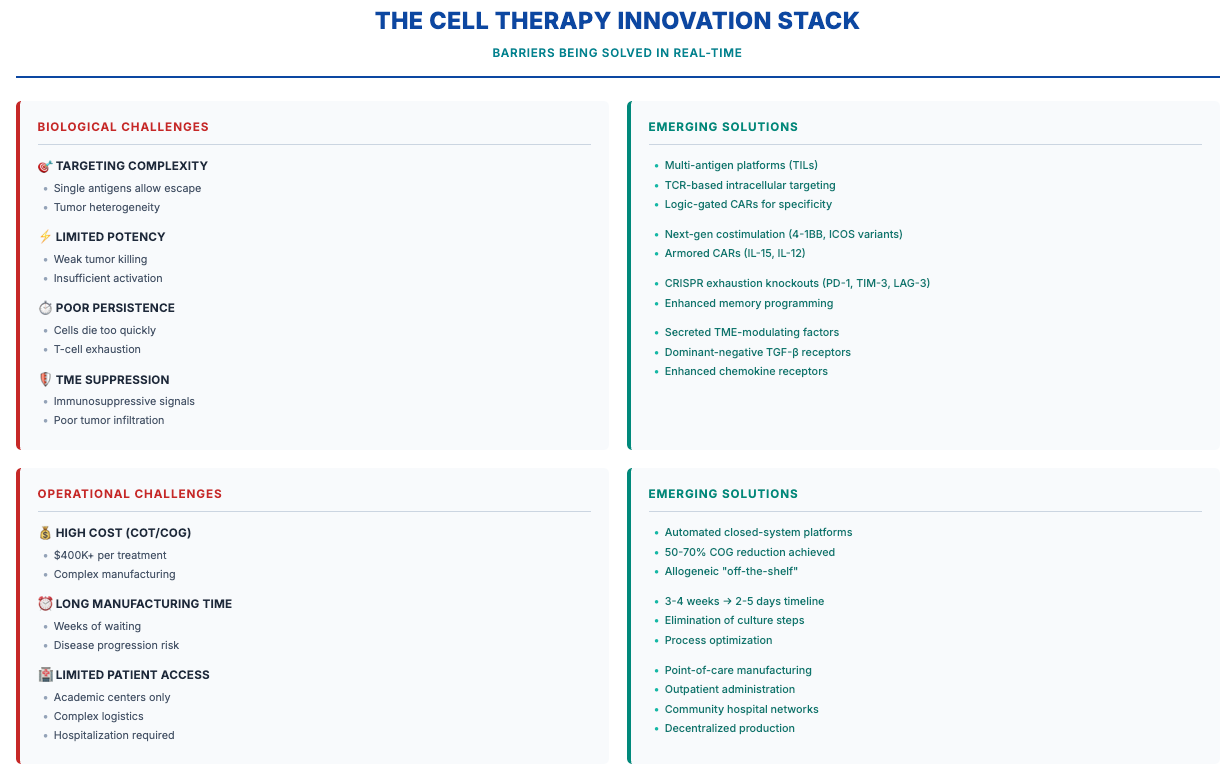

We are at risk of losing technological momentum and US leadership in this critical technology precisely when breakthrough solutions are materializing. The next generation of cell therapies is actively addressing the fundamental barriers that have historically constrained the field—and this progress is happening across both biological and operational fronts.

The Barriers Are Being Solved—Right Now

The biological challenges—targeting complexity, limited potency, poor persistence, TME suppression—are yielding to innovative engineering approaches emerging from labs and entering clinical validation. Multi-antigen platforms, intracellular targeting, enhanced co-stimulation, and TME resistance modules are no longer theoretical; they’re generating clinical data.

Simultaneously, operational advances are making cell therapy scalable and accessible. Manufacturing timelines have compressed from weeks to days. Costs are dropping 50-70%. Point-of-care production and outpatient administration are eliminating the logistical barriers that limited first-generation products. Off-the-shelf approaches like allogeneic, iPSC, and in vivo are showing immense promise. What once required specialized academic centers can increasingly be delivered in community hospitals where most patients receive care.

Many of these innovations are in clinical development now, with data emerging and regulatory paths clarifying. We have the toolbox. We have proof it works in patients. We have multiple shots on goal.

This is not the time to give up. The field needs thoughtful, bold investment to get us not to the finish line but to the next era of medicine where cell-based therapies lead the way to curative opportunities across therapeutic areas.

Rather than marking the cell therapy class as “out of favor,” investors should prioritize technologies demonstrating genuine solutions to these barriers—greater patient eligibility, shorter time to treatment, reduced manufacturing complexity, validated TME-overcoming capabilities. Capital should flow to differentiated platforms with clear line of sight to addressing unmet biological and operational challenges, not to undifferentiated programs replicating past mistakes.

The Developer’s Responsibility: Differentiation Over Duplication

On the other hand, drug developers must learn from history. The field famously saw 150-200+ unique CD19 CAR-T programs in the 2020-2021 timeframe—an unwarranted number given the actual unmet need and commercial opportunity. There was no way all of these could succeed in the market, and a mass culling was predictable and necessary.

Today’s developers should ask hard questions before initiating programs: Does this approach solve a real biological barrier that existing therapies don’t address? Does it meaningfully reduce manufacturing cost or complexity? Does it expand the treatable patient population? Without clear affirmative answers, they risk perpetuating the cycle of overcrowding that contributed to today’s environment.

🎯 The Cell Therapy Reality Check: We’re Closer Than We Think We have regulatory precedent (AMTAGVI approved February 2024) We have proof of concept (meaningful CRs in solid tumors) We have the engineering toolkit to iterate and optimize We have solutions emerging for both biological and operational barriers The question isn’t whether cell therapy can cure solid tumors—it’s whether we’ll sustain investment through the engineering optimization phase that separates breakthrough technologies from abandoned potential. This is the moment for bold, thoughtful capital allocation to differentiated platforms. The next era of medicine—where cell-based therapies deliver durable cures across oncology and beyond—is within reach.

Cell therapy holds tremendous potential to cure solid tumors. We have proof we can meaningfully shrink tumors through AMTAGVI, IMA203, and other earlier-stage programs. We have regulatory precedent. We have multiple shots on goal. Cell therapy’s programmability offers unique advantages to quickly iterate, tinker, and enhance that other approaches can’t quite replicate.

The Choice: Sustain rational capital allocation through the difficult development phase, or abandon the modality with the strongest curative potential just as technical hurdles become solvable.

Cell therapy for solid tumors isn’t failing—it’s transitioning from proof-of-concept to engineering optimization. The work gets harder before it gets easier, but that’s exactly when sustained investment separates breakthrough technologies from abandoned potential.

If we want to cure solid tumors, we need to keep investing in cell therapy, even when it’s hard. Don’t confuse market correction with fundamental failure. Don’t flinch at the finish line.

would like to know about allogeneic cell therapy vs bispecific across hematology oncology and autoimmune disease, from efficacy and potential market adoption , simply which one will eventually rule the space 🙏