Moderna's Oncology Inflection Point: When Platform Dreams Meet Strategic Reality

Heads up, reader! This post may be too long for email, and thus get truncated by your email service provider. I suggest reading in your browser or in the substack app to get the full experience.

The full version of this analysis and all my past work is available for paid subscribers. If you like what you see, please consider becoming a paid subscriber by clicking the button below.Moderna's Q2 2025 earnings call revealed a company at a critical juncture. Revenue hit $142 million, beating estimates, but management announced they're cutting 10% of the workforce. Here's an organization sitting on $7.5 billion in cash yet reducing headcount to save about $1.5B.

Morgan Stanley held their Equal-weight rating unchanged despite the beat - that $31 price target tells you everything about where the market stands on platform premiums these days. They've stopped paying for potential and started demanding proof.

In a previous post, I flagged this strategic drift - their platform-centric, TA-agnostic approach risked creating exactly these constraints. We're now watching those predictions play out in real time.

The Revenue Cliff: Post-COVID Economics Take Hold

The Q2 numbers strip away any remaining illusions about COVID tailwinds. Revenue cratered 41% year-over-year to $142 million, posting an $825 million net loss. COVID vaccine sales contributed just $114 million quarterly - pocket change compared to pandemic peaks.

Management slashed full-year guidance from $2.5 billion down to $1.5-2.2 billion, citing UK delivery timing that exposes their continued reliance on government contracts over commercial markets.

Cost reduction targets are aggressive: $1 billion cuts this year, another $500 million in 2026, shooting for breakeven by 2028. OpEx dropped 27% to $1.1 billion, but the math still doesn't work at current revenue run rates.

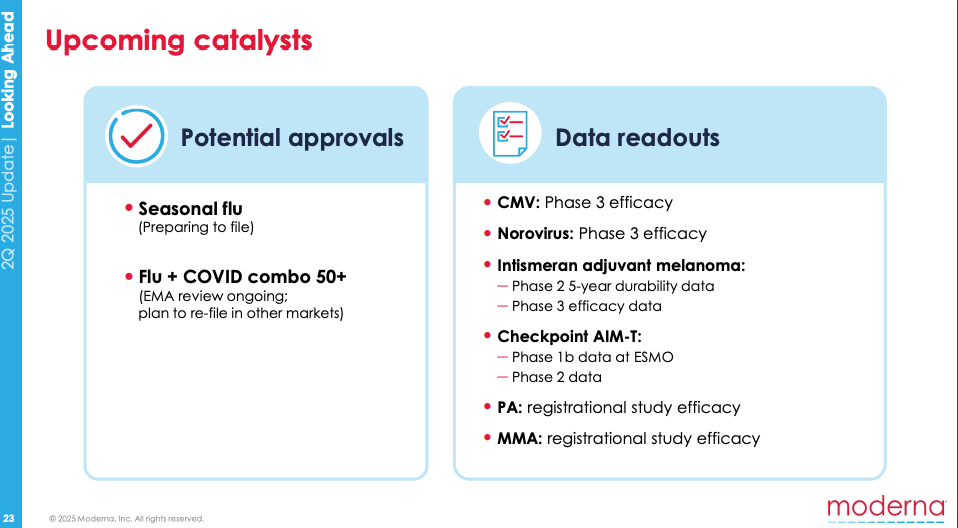

Their virus programs matter for deepening their vaccine franchise. CMV Phase 3 data this fall, RSV mRESVIA approvals, COVID/flu combo resubmission - success maintains their infectious disease positioning. Setbacks would sting but wouldn't fundamentally change their vaccine company identity.

We saw many of the other COVID darlings (Pfizer, and BioNTech notably) leverage their windfalls to exact a string of BD&L that prepared their pipelines and commercial revenue streams for the post COVID era. Moderna at one point was seeing $18B in peak COVID-era revenues for Spikevax. Obviously, no one thought that that would continue as the pandemic waned and moved into an endemic phase. While its peers invested their profits in new drugs, Moderna was a bit hamstrung by their corporate strategy. They are an mRNA only-company and are agnostic to TA. That’s not a bad thing, but it is a choice. There are less things to buy for an mRNA company than an Oncology company (BioNTech). Still, there was a hope that the peak was supposed to fund platform expansion. Instead, we're observing a steady decline.

We saw many of the other COVID darlings (Pfizer, and BioNTech notably) leverage their windfalls to exact a string of BD&L that prepared their pipelines and commercial revenue streams for the post COVID era. Moderna at one point was seeing $18B in peak COVID-era revenues for Spikevax. Obviously, no one thought that that would continue as the pandemic waned and moved into an endemic phase. While its peers invested their profits in new drugs, Moderna was a bit hamstrung by their corporate strategy. They are an mRNA only-company and are agnostic to TA. That’s not a bad thing, but it is a choice. There are less things to buy for an mRNA company than an Oncology company (BioNTech). Still, there was a hope that the peak was supposed to fund platform expansion. Instead, we're observing a steady decline.

The Alnylam Playbook: How Platform Companies Can Evolve

Want to understand what Moderna could have done differently in the post-COVID era? Look at Alnylam. Both companies built around RNA technologies facing identical delivery challenges. Their approaches to solving those challenges reveal completely different strategic philosophies.

Alnylam ran disciplined platform evolution. Started narrow with rare genetic diseases - clear target validation, predictable regulatory paths. Onpattro for hATTR in 2018. Givlaari for acute hepatic porphyria in 2019. Oxlumo for primary hyperoxaluria in 2020. Each commercial success built therapeutic expertise, regulatory relationships, and cash flow enabling systematic expansion into cardiovascular, CNS, and infectious disease applications.

In contrast, Moderna was shot out of a cannon, with mRNA programs in every disease area under the sun. They were incredibly well funded as a private company and spread themselves too thin in the early days. Multiple irons in the fire waiting for one hit. In some ways the pandemic forced them into picking lane. They were the right technology at the right place at the right time, but pre-COVID, never did you get the sense that they had an organizing principle behind their corporate strategy other than “mRNA for everything”. Maybe when the “hit” came, they were banking on that being the forcing function for their corporate strategy.

Alnylam invested relentlessly in solving core platform limitations internally. They evolved from basic LNPs to breakthrough GalNAc conjugate technology for targeted hepatocyte delivery, then Enhanced Stabilization Chemistry for improved siRNA stability. These were iterative improvements that summed to fundamental breakthroughs to unlock new therapeutic applications.

However, Moderna chose differently. Their platform investments focus on "second-generation LNPs" with improved stability and manufacturing scale. Meaningful advances, but incremental improvements to vaccine-optimized technology rather than breakthroughs needed for broader therapeutic applications. Their LNP tech remains stuck in systemic distribution mode - fine for immune activation, limited for tissue-specific targeting that would more easily unlock other lucrative TAs like autoimmune, metabolic, or CNS applications.

It's funny to think that at one point Moderna was a $180B company (Sep ’21) and is now roughly an $11B company. Alnylam around that time was in the $22-$23B range but today is at a record high of $55B.

The partnership pattern I analyzed previously tells another part of the story. Moderna consistently plays delivery truck while partners own therapeutic biology. For instance, in their cell therapy partnership with Carisma, Carisma drives CAR-Macrophage innovation while Moderna provides LNP manufacturing. With Vertex, it is Vertex who controls gene editing science and regulatory strategy while Moderna handles delivery infrastructure. You can argue that both of these partnerships were solid endeavors. Maybe in the Carisma case, the Moderna folks picked the wrong cell-type and perhaps opting to participate in in vivo CAR-T for something like auto-immune disease would have led to a more fruitful partnership.

Putting partner selection aside though, these types of deals reflects organizational DNA optimized for immune activation and mRNA manufacturing, not the comprehensive platform capabilities and evolutionary plan needed for independent value capture that a company like Alnylam is currently living.

Oncology: Where Strategic Fate Gets Decided

Vaccine programs affect performance within established capabilities. Moderna’s most anticipated oncology program is intismeran (INT, Neoantigen mRNA vaccine), partnered with Merck. The lead program is in adjuvant melanoma, in combination with pembrolizumab, with readouts set to determine what kind of company Moderna becomes. This could be the first real proof that mRNA medicines have a commercial future beyond preventing or mitigating the severity of infectious diseases.