Pfizer Acquires a GLP-1 Pipeline and Revives FOMO Corporate Strategy

Discussing Pfizer's savvy acquisition of Metsera and critiquing the GLP-1 'gap analysis' many outsiders promote as a reason all the Big Pharmas will be in GLP-1

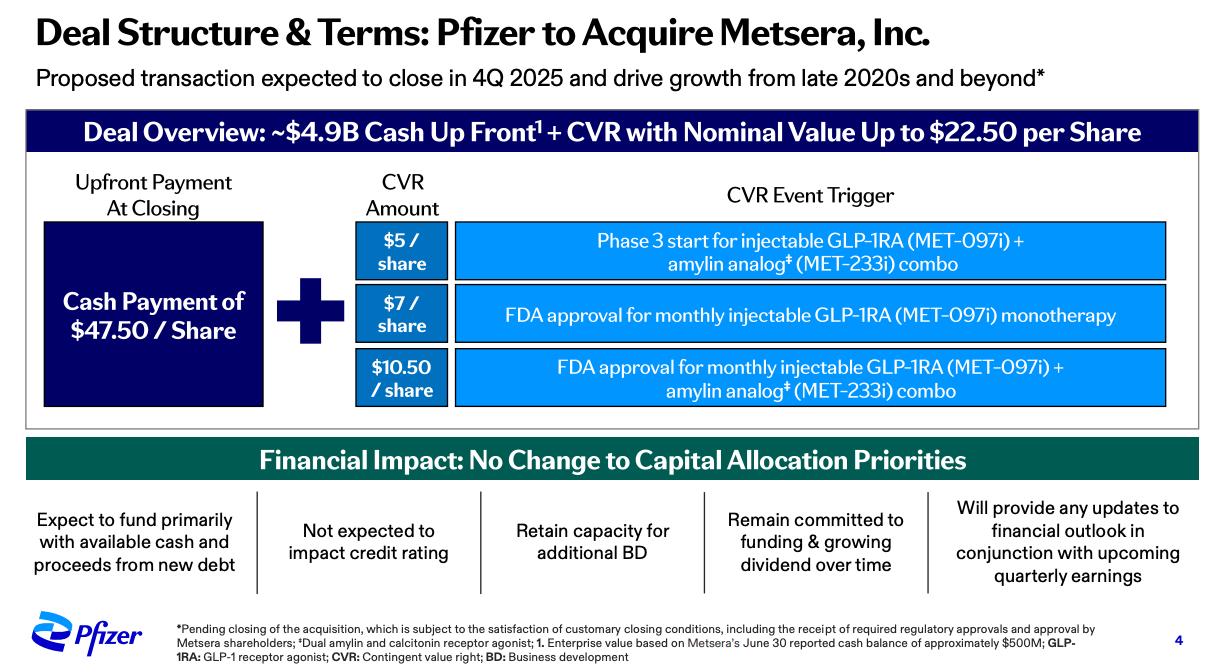

On Monday, Pfizer PFE 0.00%↑ announced it is acquiring Metsera MTSR 0.00%↑ and its obesity pipeline. The deal values MTSR at ~$4.9B upfront and up to $7.3B based on milestones outlined in a contingent value right (CVR).

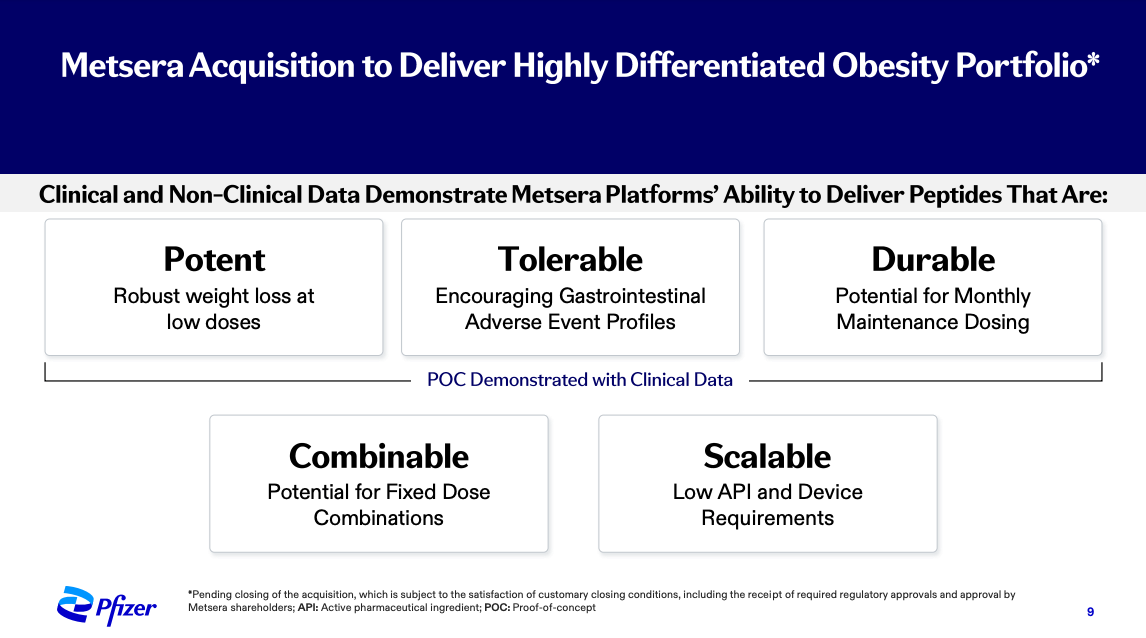

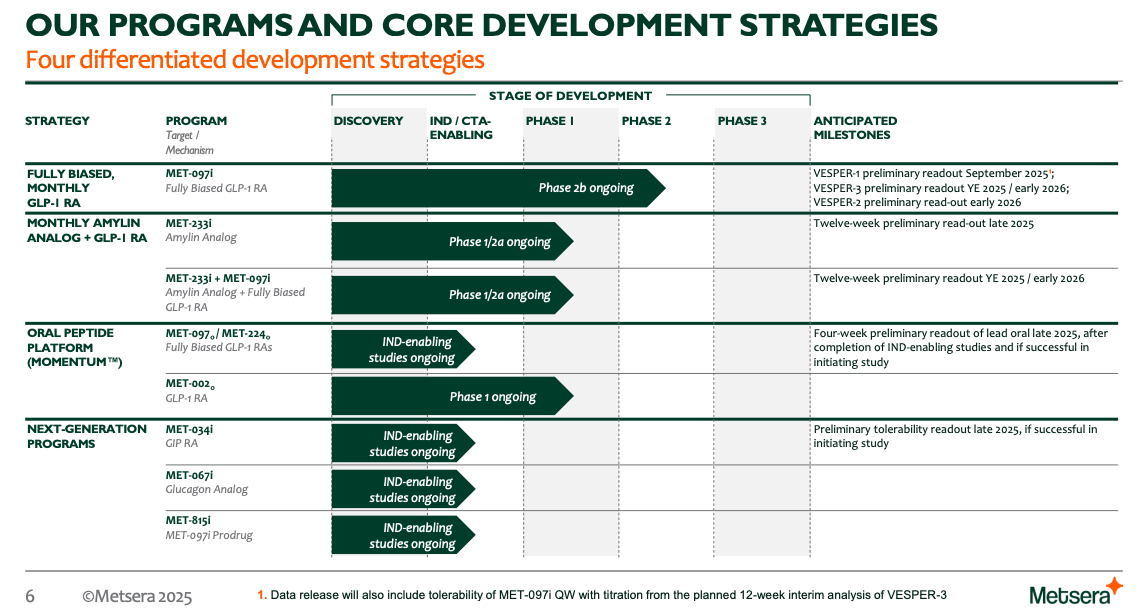

Key to the acquisition is Metsera’s diverse pipeline of obesity assets, spanning both oral and injectable GLP-1RAs, and combinatory mechanisms of actions like GIPR, Glucagon, and Amylin. Metsera’s lead asset is MET-097i a potential once-monthly formulation of GLP-1RA with improved efficacy and lower GI AEs (nausea, vomiting, diarrhea) compared to on-market competitors. Notably 097i is entering late-stage studies next year and its oral form could enter the clinic by the end of this year.

A smart move for Pfizer

This deal makes a ton of sense for Pfizer, who to this point had endeavored to make their mark in the GLP-1 space with its own pipeline. However, over the course of the last few years, Pfizer discontinued danuglipron, lotiglipron, and PF-06954522, the first two due to concerning liver enzyme elevations seen in clinical studies. Leading up to the Metsera acquisition, Pfizer management was pretty open about its interest in doing a deal to re-enter this space with differentiated long-acting and oral GLP-1 candidates. Metsera seems to fit that bill to a tee.

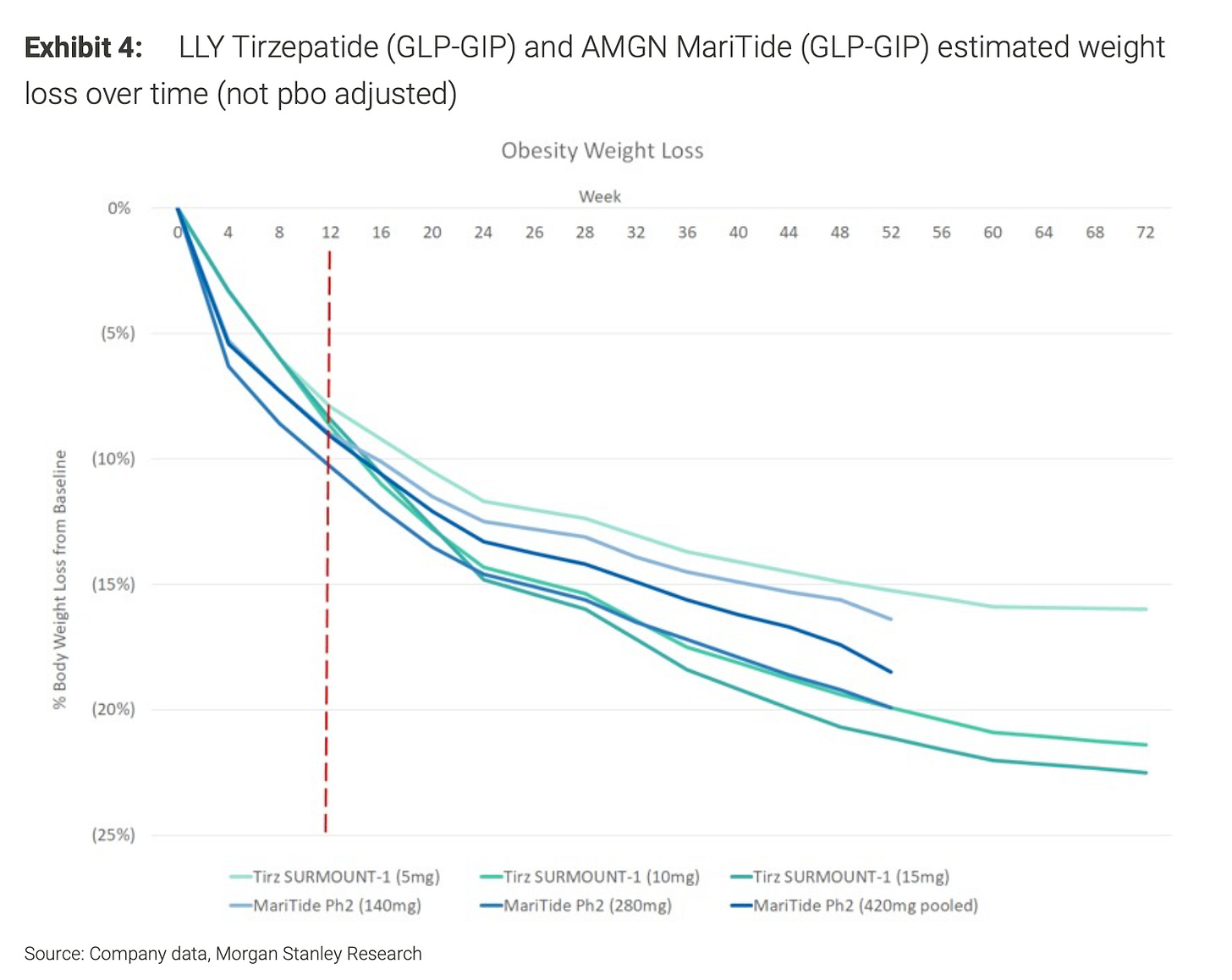

The Metsera pipeline checks the differentiation box, potentially offering more potent weight loss, with less side effects, easier titration, and more flexible dosing options. On Pfizer’s post-deal call, they alluded to having seen some of Metsera’s forthcoming VESPER-3 data disclosure, which reinforced confidence in MET-097i differentiated profile. I am not going to do a full side-by-side of the data vs. competitors, but the chart below from the folks at Morgan Stanley does a nice job highlighting how the early efficacy results are tracking. MET-097i has shown roughly 10% weight loss at just under three months. This tracks with Amgen’s MariTide and looks to be outpacing Lilly’s ZEPBOUND. Although this is perhaps slightly behind retatrutide at this early time point.

Moreover, it is clear that the future of this class is one of combinations. We started with GLP-1s like WEGOVY, have progressed to GLP-1 + GIPR targeting agents like ZEPBOUND, and are nearing entry of GLP-1 + GIPR + Glucagon (Lilly’s retatrutide). Beyond that, companies are pursuing amylin analogs in combination with GLP-1s, as well as muscle preserving targets like myostatin and activin-A. Metsera comes furnished with injectable and oral forms of all these, sans muscle preservers, providing Pfizer with a healthy palette of diverse molecules to help address multiple customer segments within obesity, but more importantly, the wide swath of adjacent diseases where GLP-1 based treatment has started to show therapeutic promise.

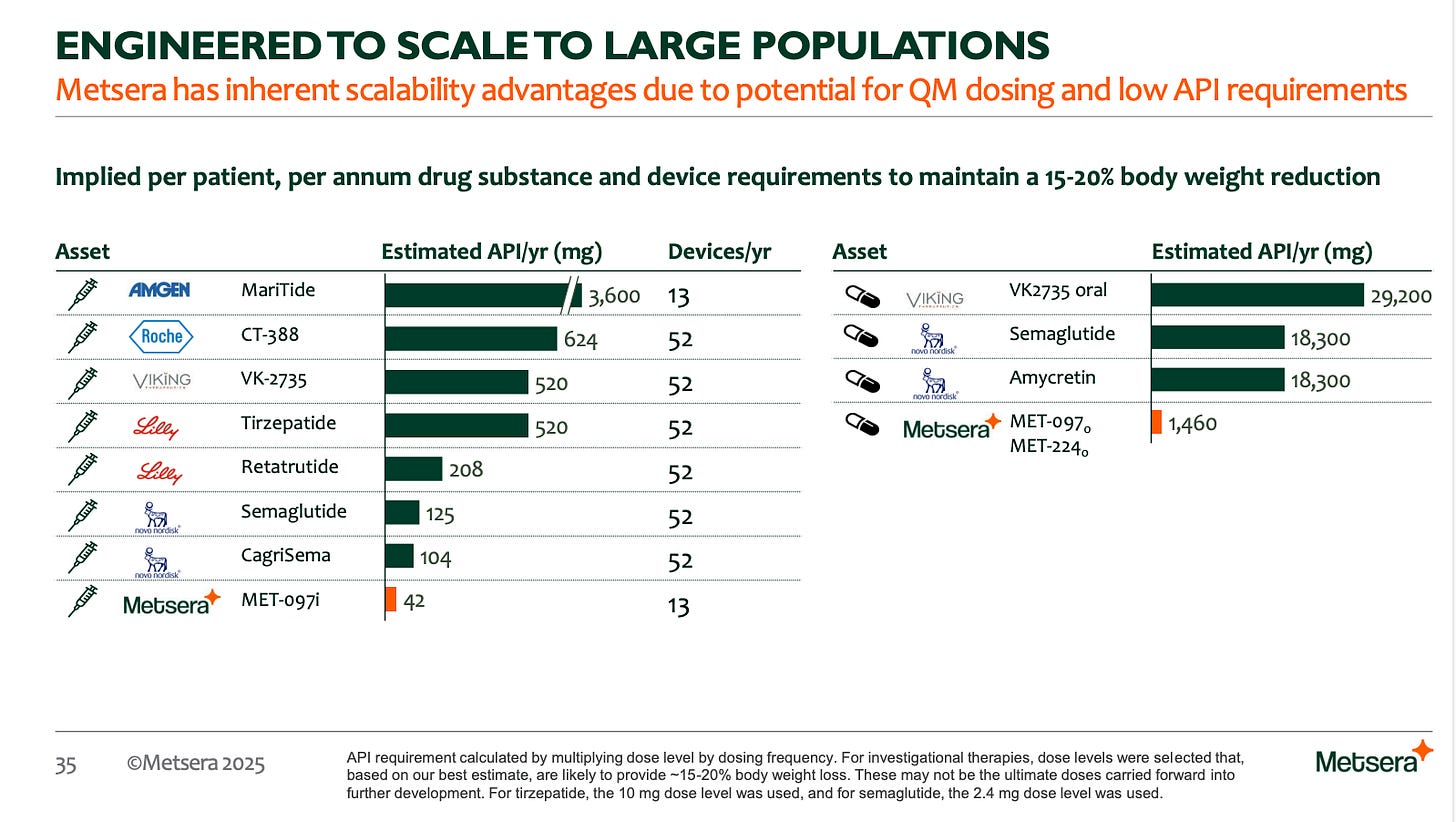

Putting myself in Pfizer’s shoes, the real kicker, beyond the potential for a better product profile, is how the potency and dosing of Metsera’s molecules lower API requirements and impact COGs. Metsera has a nice slide on this below, and assuming their calculations are true, this COGs delta could prove to be a valuable commercial advantage. What we’ve seen from the early returns in the obesity market is that it is heavily consumer-driven. Most (pretty much all aside from a few) don’t cover GLP-1s for weight loss. That may change with time and more data, but I don’t see the consumer/cash pay portion of this market going away anytime soon. Right now it’s roughly $500/month for WEGOVY or ZEPBOUND. As a latecomer to this market with two well-established competitors that are far ahead, having this COGS advantage is key as it afford Pfizer more price flexibility in a cash-pay market. Coming in at a lower price is one way you can drive up your market share as a third or fourth to market player.

Overall I like this deal for Pfizer and I imagine they will continue to invest heavily in building out the clinical programs for Metsera’s portfolio beyond obesity, both to help stem revenue loss from LOEs of ELIQUIS and eventually leverage that commercial footprint towards its budding obesity portfolio.