Six Biotechs Getting Acquired in 2026

Ahead of JPM, here are the six companies I think will be acquired by the end of the year

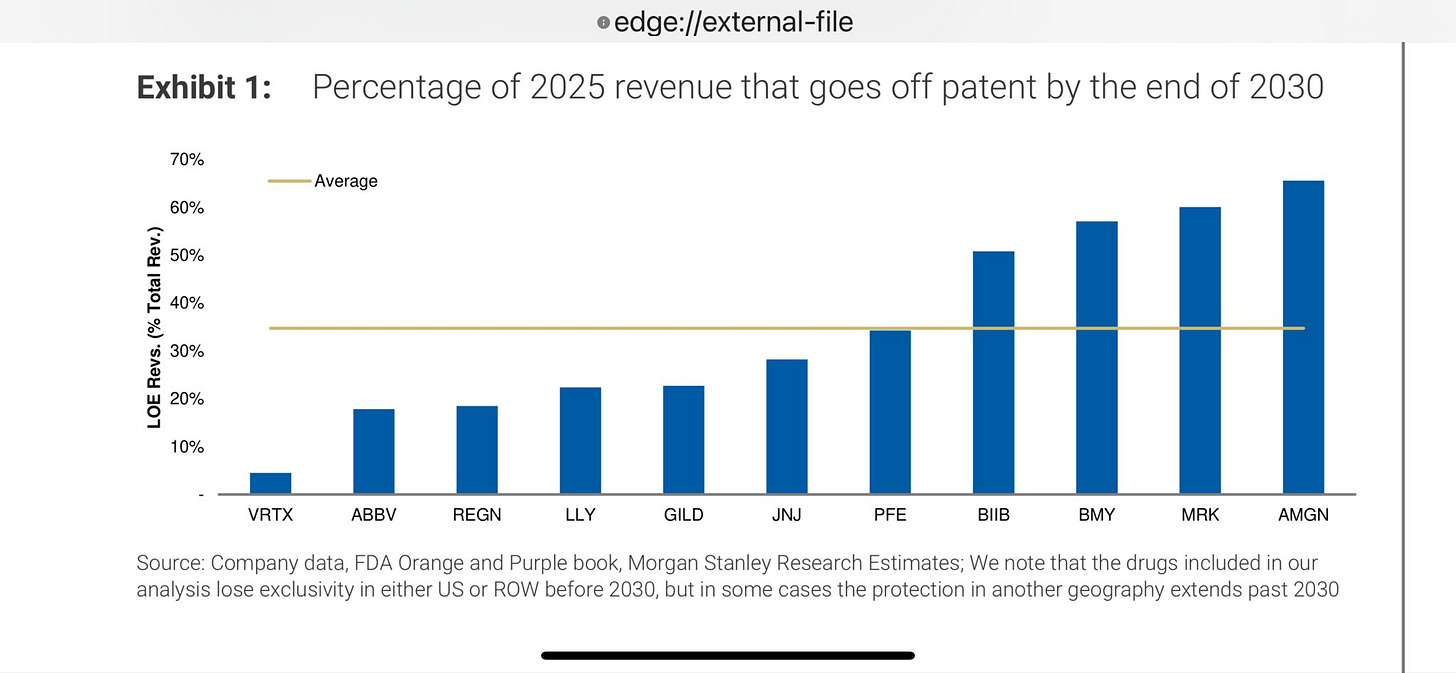

Welcome back! I hope all of you experienced a restful holiday and are having a strong start to the new year. January in Biopharma is signified by the JP Morgan Healthcare Conference (JPM). This is where deal discussions begin for the coming year and also where major deals get announced. Anecdotally, we have seen M&A appetite from Big Pharma/Biotech pick up over the last few years. Buzz and rumors are accordingly picking up as well. Much of this has to do with everyone’s favorite two words [pause for effect]: Patent Cliffs!

2026 will be marked by healthy M&A activity from the top 15-20 or so players in our sector. And to that end, I thought a great way to kick off the year headed into JPM is to highlight who I think has a strong chance of getting acquired this year. Below I’ve stated the case for six companies (and maybe a bonus one or two) that I think will be acquired over the course of 2026.

If you enjoy strategic analyses, insights, and opinions about Biotech and Pharma from an insider’s perspective, you can get access to all Big Pharma Sharma content by becoming a paid subscriber. Thanks for your support!

2026 will be marked by healthy M&A activity from the Top 15-20 or so players in our sector. And to that end, I thought a great way to kick off the year headed into JPM is to highlight who I think has a strong chance of getting acquired this year.

Below I’ve stated the case for six companies (and maybe a bonus one or two) that I think will be acquired over the course of 2026.

If you enjoy strategic analyses, insights, and opinions about the Biotech and Pharma from an insider’s perspective, you can get access to all Big Pharma Sharma content becoming a paid subscriber. Thanks for your support!