The In Vivo Gold Rush: Big Pharma's $3B Cell Therapy Bet

Why Kite's entry into in vivo cell therapy marks a pivotal moment for an industry seeking to overcome the cost and scalability challenges of autologous CAR-T

The full version of this analysis and all my past work is available for paid subscribers. If you're a free subscriber you'll only be able to read part of this post. If you like what you read, please consider becoming a paid subscriber to unlock all my content by clicking the button below.I woke up yesterday morning to some surprising news. Gilead (Kite) just entered into the highly competitive in vivo cell therapy space with its acquisition of Interius BioTherapeutics for $350M. This follows string of recent deal activity which saw AbbVie acquire Capstan (for up to $2.1B) and AstraZeneca acquire EsoBiotec (for up to $1B).

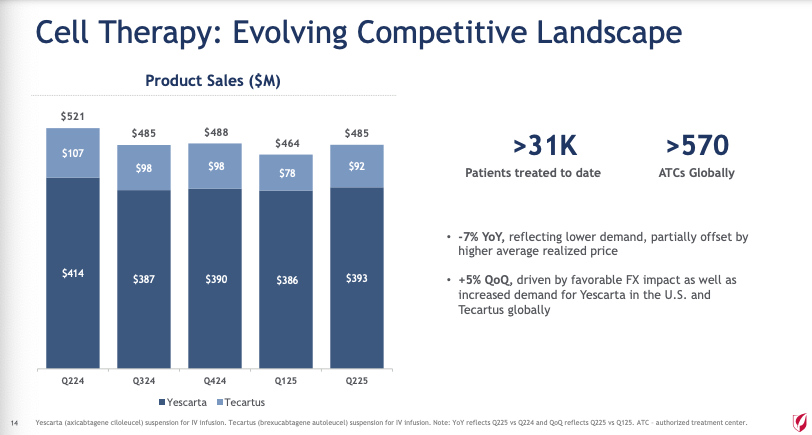

This deal is significant for a number of reasons, as it is the first acquisition in this space by a leading commercial cell therapy player. While Kite’s CD19 CAR-T franchise continues to be a category leader, its place on that pedestal has been threatened as of late by growth of J&J’s CARVYKTI in Multiple Myeloma, in-class competition from BMS’ BREYANZI, as well as out-of-class bispecific antibodies that can readily be given off-the-shelf and more easily administered in the community-setting, while still retaining an attractive therapeutic profile. The latter two factors have combined to flatline CD19 CAR-T sales for Gilead over the past several quarters.

Why now for Gilead/Kite and how does this fit?

We all know manufacturing autologous cell therapies is really expensive. Kite and others have steadily pushed down costs by increasing scale and exploring faster/shorter manufacturing methods, but those methods have their fundamental limits, which now close to 8-years post-acquisition, I would think we are already at or well-past. In vivo, in oversimplified terms, helps transform autologous cell therapy into gene therapy. Rather than manufacturing your product outside the patients body and shipping it back to them, you can infuse the patients body with a vector that makes the product right inside them. This eliminates the complicated logistics, protracted turnaround time, and manufacturing investment that have bogged down autologous CAR-T.

Having worked on the Kite deal itself during my Gilead days, helping to shape the company’s strategy post-acquisition, and seeing how things have unfolded since then, I can tell you that in vivo was always the final frontier. The surprise to me is that all the steps in between to get to in vivo have largely not worked well or have been slow to progress. Healthy-donor allogeneic approaches from companies like Allogene, Caribou, CRISPR, and Precision Biosciences have had their set backs and delays. The field of “non-classical” (aka non-T-cell) based approaches like NKs, NK-Ts, and gamma-deltas have moved slowly and faced hurdles generating potent and persistent product. IPSC derived approaches, like those of Fate and Century Therapeutics were all the rage for a time and at one point felt like they caught up to healthy-donor allogeneic approaches, before running into their own product challenges. Fast-CAR approaches (which I’ve written about extensively before) have also shown promise, but also have their own speed limitations related to regularly requirements for release-testing. Decentralized models, like what the folks at Galapagos were (are?) championing also looked super interesting, but again progress has seemed to stagnate.

All of this comes at a time, over the last few years, where biotech at large has been hit really hard by the macroeconomic headwinds - but cell therapy, the most capital intensive segment of biotech, especially so. We’ve seen companies shut down, get acquired for pennies, and also pivot into autoimmune disease to try an breath new life only to then be acquired for a discount. The stories have been all too common. Amidst this climate, where forbearing technologies had run into hurdles and either slowed or gone by the way side, the field of in vivo cell therapy has been able to catch up and reach an inflection point.

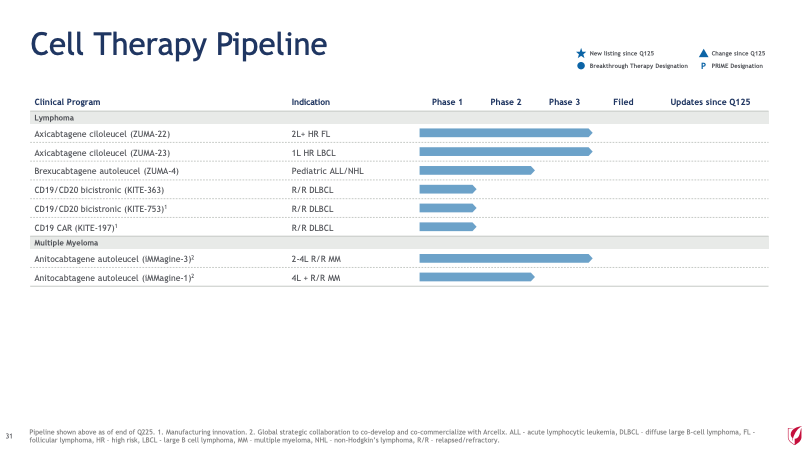

Kite too has invested in many if not all of the above precursor approaches either themselves or via partners, but nothing has gained much traction. The pipeline remains thin and is a shadow of what was once a grand vision of multiple successive iPhone-like generations of iteratively better products across key verticals. What was once thought to be a platform acquisition has in-practice become more of a pipeline-in-a-product type acquisition. There’s nothing wrong with that, it’s just different than what the initial vision was and the reasons for this deserve its own post. Either way its still a company that is manufacturing a phenomenal drug (and potentially another one on the way in anito-cel) that is generating blockbuster revenues, albeit potentially hitting a commercial ceiling with its current label.

Buying into in vivo takes the cap off that commercial ceiling over the long term, enabling CD19-based CAR-T therapies to treat more patients at lower COGS and importantly, in more indications - including immunology and inflammation (I&I). This has been an area where Gilead/Kite has indicated interest, but not taking significant public steps forward in. Now having a portfolio of in vivo assets in-hand, the company can more easily adapt to commercial scale, pricing, and rebate-shenanigans required to be a commercial success in that space. Certainly all of this new stuff needs to work and have the clinical data to prove it, but I commend the company for taking its medicine and going down the in vivo path, albeit after some of its up and coming competitors have.